Navigating TangleSwap's $VOID Public Token Sale

Just like the first rays of dawn that bring light to the cosmos, the launch of TangleSwap's $VOID token marks a new era in Decentralized Finance (DeFi) within the Cardano and IOTA ecosystems. Distinguished by the debut of the innovative Concentrated Liquidity Market Maker (CLMM) — a first in both ecosystems — TangleSwap sets the stage to redefine their DeFi landscape by enhancing liquidity depth, trading efficiency, and ushering in unparalleled opportunities for growth and innovation. This transformative move is further complemented by 4 additional state-of-the-art DeFi dApps, from Vote-Escrowed Staking to 'Smart' Farms.

- Cardano Public Sale: 14th December 2023, 4:00 pm UTC (ends after 24h).

- IOTA Public Sale: 15th December 2023, 4:00 pm UTC (ends after 24h).

- Everything you need to know: It’s Time — TangleSwap’s $VOID Token Sale, Unveiled.

- Or if you prefer a real-time conversation — chat or voice — then talk to TangleSwapGPT.

Click here to explore TangleSwap's Edge over existing DEXs on both Cardano and Iota! 🤓

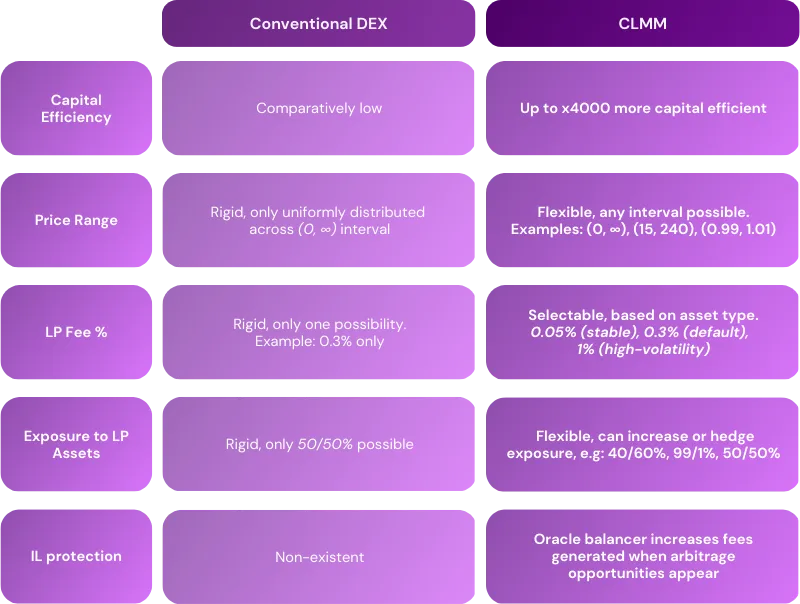

Comparing TangleSwap to existing DEX solutions in the Cardano and Iota ecosystems reveals several key differences:

CLMM vs. Automated Market Maker (AMM) ✅

For liquidity providers (LPs), passive CLMM positions — i.e. those not requiring active management by the LPs — outperform comparable AMM DEX positions by an average of ~54%. The result for LPs is a superior average yield returned on their assets — or, seen from another perspective, LPs are empowered to invest considerably smaller amounts in a CLMM and benefit from similar returns compared to a conventional AMM.

For liquidity farmers, the TangleSwap protocol offers a groundbreaking Asteroid Farms system, uniquely and deeply intertwined with the CLMM to optimize reward distribution towards high-value LPs, in line with our core ethos around sustainable growth. As the ecosystem grows and matures, this unique ‘smart farming’ system will prove invaluable in fostering prolonged, retentive growth of liquidity.

For stakers and governance participants, they benefit from a fully custom-built Void Energy mechanism that serves a dual purpose: it inherently directs staking rewards towards long-term supporters, while providing the means for a tailor-made governance system that — crucially — is not based on mercenary coin holdings but instead aligns with the future of robust, equitable decentralized systems.

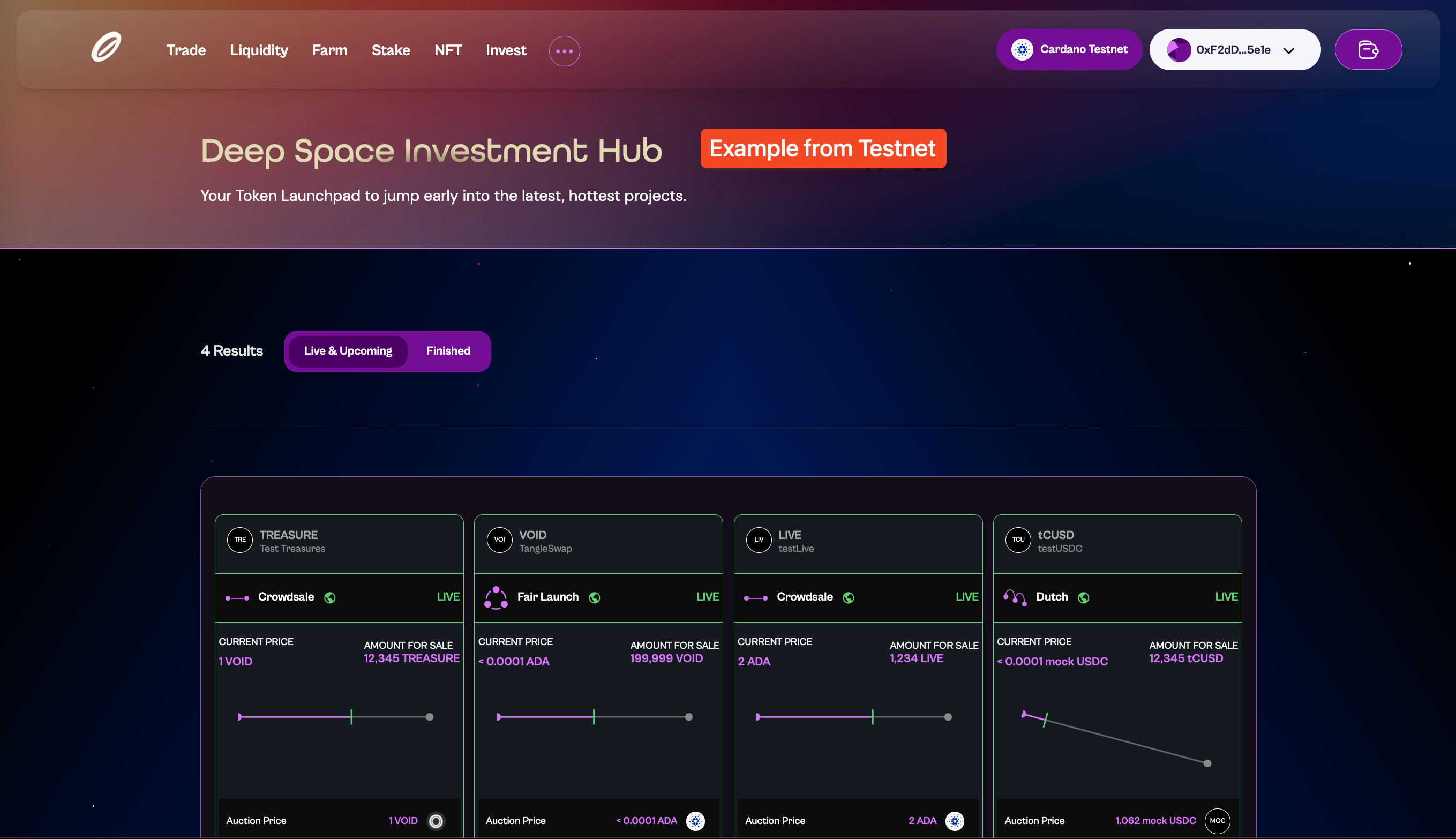

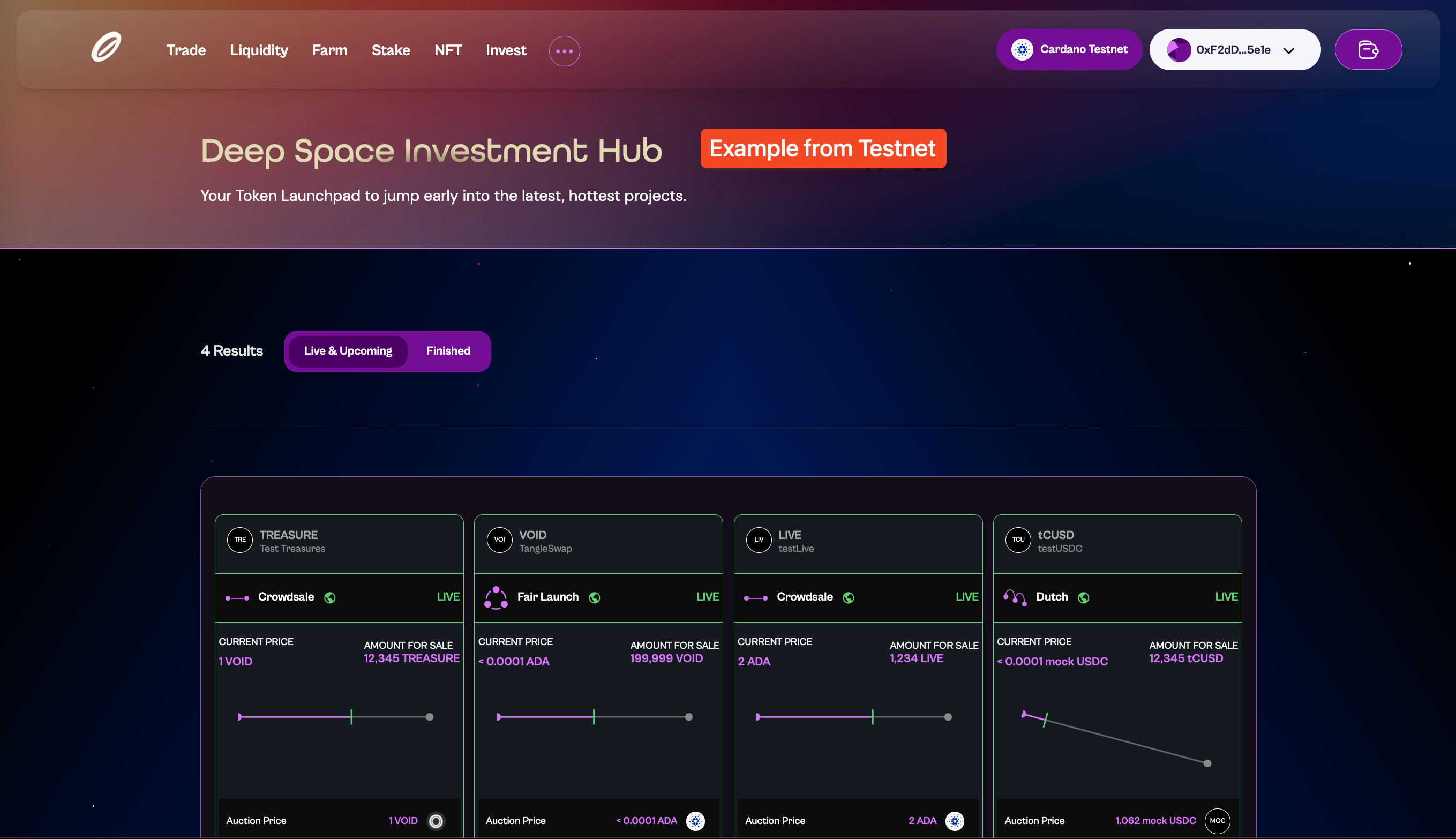

For investors of all experience levels, from seasoned market experts to those embarking on their personal investment journey, TangleSwap’s Investment Hub — also known as Token Launchpad — presents a unique opportunity for users to discover and invest in early-stage ventures based on their individual risk appetite. At the same time, emerging projects benefit from a highly efficient, fully-fledged, and reputable decentralized fundraising platform.

CLMM vs. Orderbook DEX 🧠

Typically, when trading on a CEX, you're transacting not with another individual user but with a Market Maker. This requirement often leads to additional fees for projects and high demand for professional Market Makers. In contrast, TangleSwap's CLMM model democratizes this process. It allows users to assume the role of Market Makers themselves – hence the term, Concentrated Liquidity Market Maker – without needing extensive knowledge or large capital outlays. This approach not only provides the same level of flexibility but also enhances efficiency, and decentralization. The efficient distribution achieved through CLMM's Concentrated Liquidity often surpasses many CEXs, offering deeper liquidity and higher profitability for Liquidity Providers. This efficiency is vital in the volatile crypto environment, where fully permissionless — i.e. truly decentralized — and scalable infrastructure is key.

Moreover, unlike Orderbook DEXs that still require professional Market Makers to avoid large spreads and unpredictable price actions, CLMM eliminates this need. The system's inherent efficiency ensures that Liquidity Providers enjoy both depth and profitability, which in turn attracts more volume and active trading within the ecosystem. To date, the Concentrated Liquidity approach remains unmatched in terms of liquidity depth and profitability for Liquidity Providers.

Concentrated Liquidity — responsible for over 85% of global DEX volume — is a game-changer in addressing the existing liquidity challenges in TangleSwap's ecosystems of Cardano and Iota.

How to Join the $VOID Token Sale on TangleSwap

If you are looking to secure your spot in the upcoming $VOID public token sale, here's how you can be a part of it:

Phase One — Get Ready

👇 Choose your preferred ecosystem and wallet for participating in the $VOID token sale!

- Sale on Cardano — Eternl/Nami

- Sale on Cardano — MetaMask

- Sale on IOTA/Shimmer — MetaMask

Here’s how to prepare for the $VOID sale on Cardano using your Eternl or Nami wallet, it's pretty simple:

Step 1: Wallet Setup

First, ensure your Eternl or Nami browser extension is installed and connected to TangleSwap. If needed, click here for a step-by-step guide.

Step 2: Fund Your Cardano Wallet

Ensure your Eternl/Nami wallet is loaded with $ADA. This is crucial both for your participation in the sale and to handle transaction gas fees. Remember to keep at least 10 ADA in your wallet to ensure a smooth experience.

Short on $ADA? Top up with ease from any Cardano exchange (decentralized or centralized) and make sure to hold your $ADA in your personal wallet. Note: in future occasions, once TangleSwap will go live on the Cardano Mainnet by the end of 2023, you'll be able to handle this process directly aboard the Tangleship. 😉

And that's it! You're all set to jump into the next phase.

Joining the $VOID token sale with MetaMask offers a convenient process to Cardano users, with one important step: you'll need to transfer your $ADA from your Cardano L1 wallet (e.g. Nami) to your Cardano L2 wallet (MetaMask). Once you've wrapped your $ADA, the steps are similar to those with Eternl/Nami.

Please keep in mind that all options (Eternl, Nami, or MetaMask) are equally valid, and equivalent in terms of user experience and participation in the sale. There is absolutely no difference other than choosing whichever approach is more comfortable for you! 💜

Here’s a step-by-step guide to getting ready for the $VOID token sale on Cardano using your MetaMask wallet:

Step 1: Wallet Setup

First, make sure that both your Nami and MetaMask browser extensions are installed. If needed, click here for a step-by-step guide.

Step 2: Fund Your Nami Wallet

Ensure your Nami wallet is loaded with $ADA. Short on $ADA? Top up with ease from any Cardano exchange (decentralized or centralized) and make sure to hold your $ADA in your personal wallet. Side note: in future occasions, once TangleSwap will go live on the Cardano Mainnet by the end of 2023, you'll be able to handle this process directly aboard the Tangleship. 😉

Step 3: Transfer $ADA from Nami to MetaMask

To join the $VOID token sale via MetaMask, you'll need to move your $ADA from your Cardano Layer 1 (L1) wallet to your Cardano Layer 2 (L2) wallet. We have illustrated below the process for Nami:

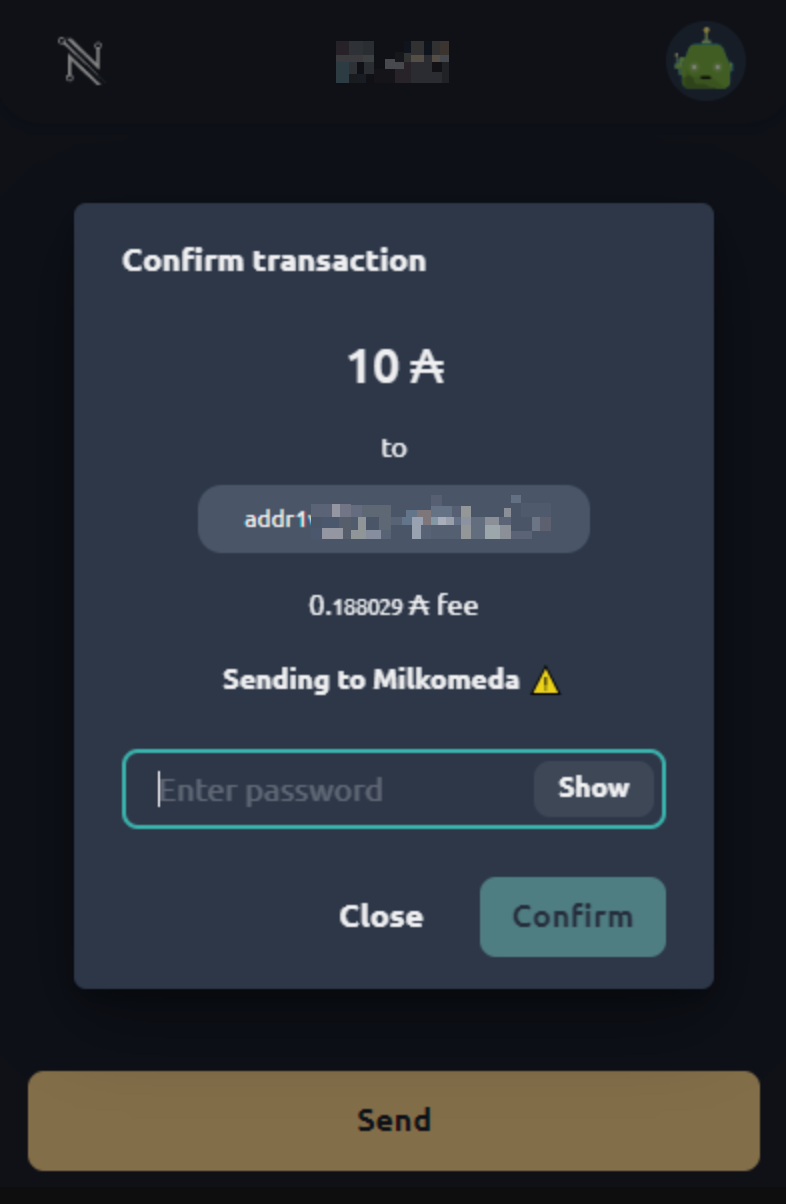

First, open your Nami wallet and click on

Send.

Then, enter your MetaMask address, the amount of $ADA you want to transfer, and click on

Send.

Enter your Nami spending password and click on

Confirm. note

noteWhen you initiate the transaction in Nami and notice "10 $ADA to

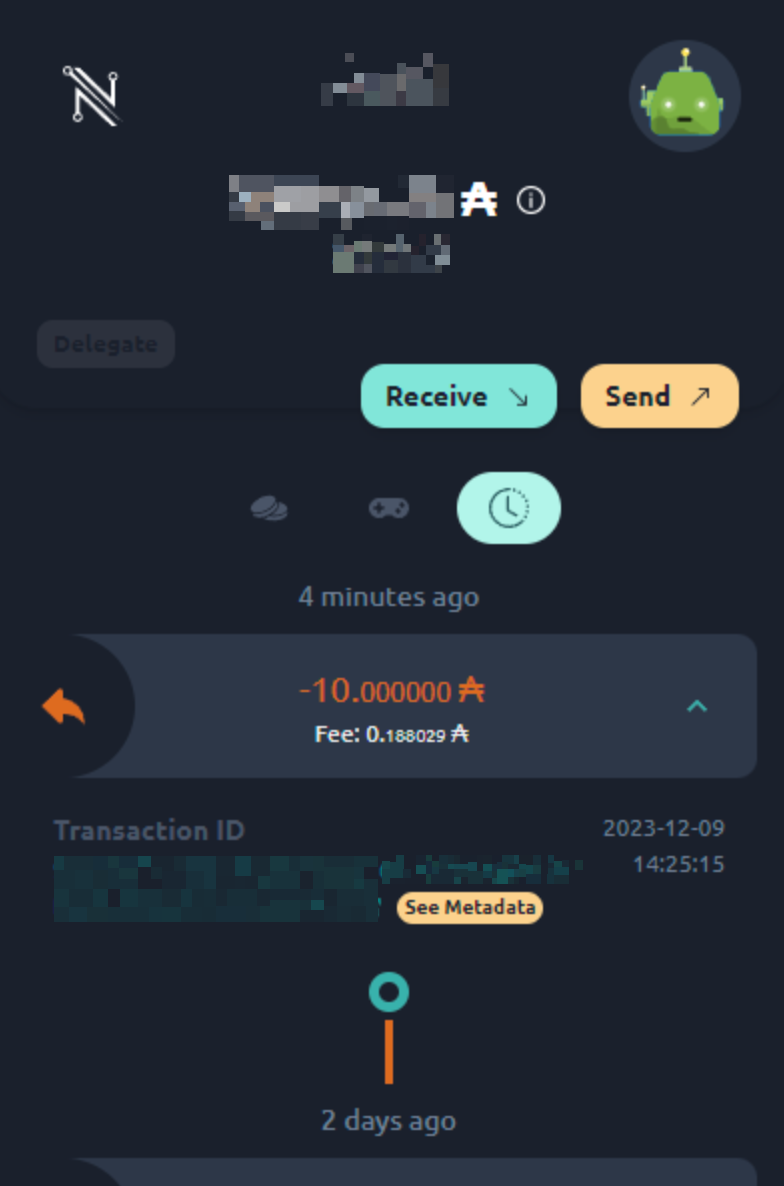

addr1..." instead of your MetaMask address, do not worry – this is part of the normal wrapping procedure. Theaddr1...address is a temporary stage for wrapping your $ADA, making it compatible with MetaMask on Cardano L2. Rest assured, once the wrapping is complete, your $ADA will be seamlessly transferred to your MetaMask wallet. You can follow the process in the official explorer.Check your transaction on Nami.

infoOnce confirmed in Nami, expect ~5 minutes for the $ADA to land in your MetaMask wallet.

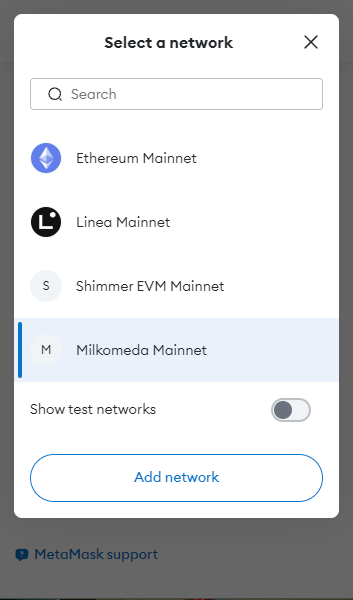

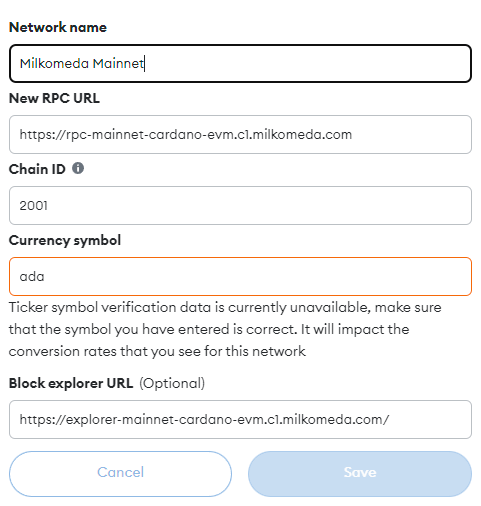

Open your MetaMask and ensure your wallet is connected to Milkomeda, the Cardano L2 EVM Mainnet. If it's not already added, simply click on

Add networkand input the details below to get connected. info

info

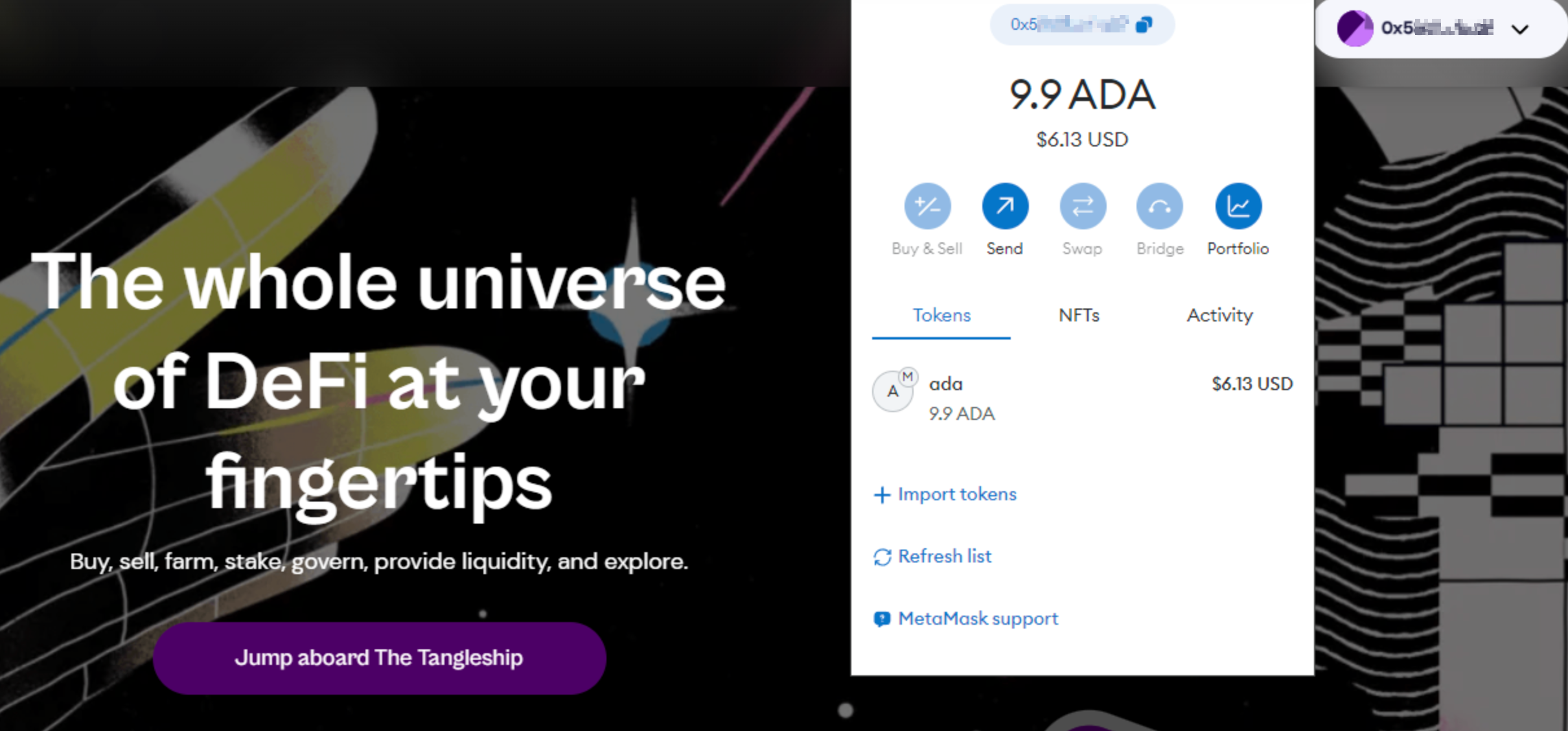

After successfully connecting to the Cardano Mainnet, your $ADA will be visible in your MetaMask.

And that's it! You're all set to jump into the next phase.

Here’s a step-by-step guide to getting ready for the $VOID token sale on the IOTA ecosystem through the ShimmerEVM, using your MetaMask wallet:

Step 1: Wallet Setup

First, make sure your MetaMask browser extension is installed, as well as your Firefly Shimmer & Firefly IOTA wallets. If needed, click here for a step-by-step guide.

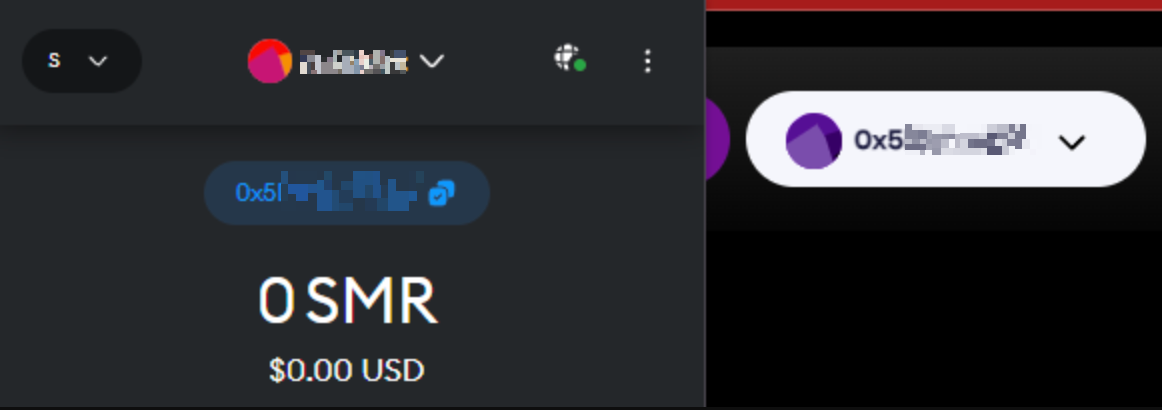

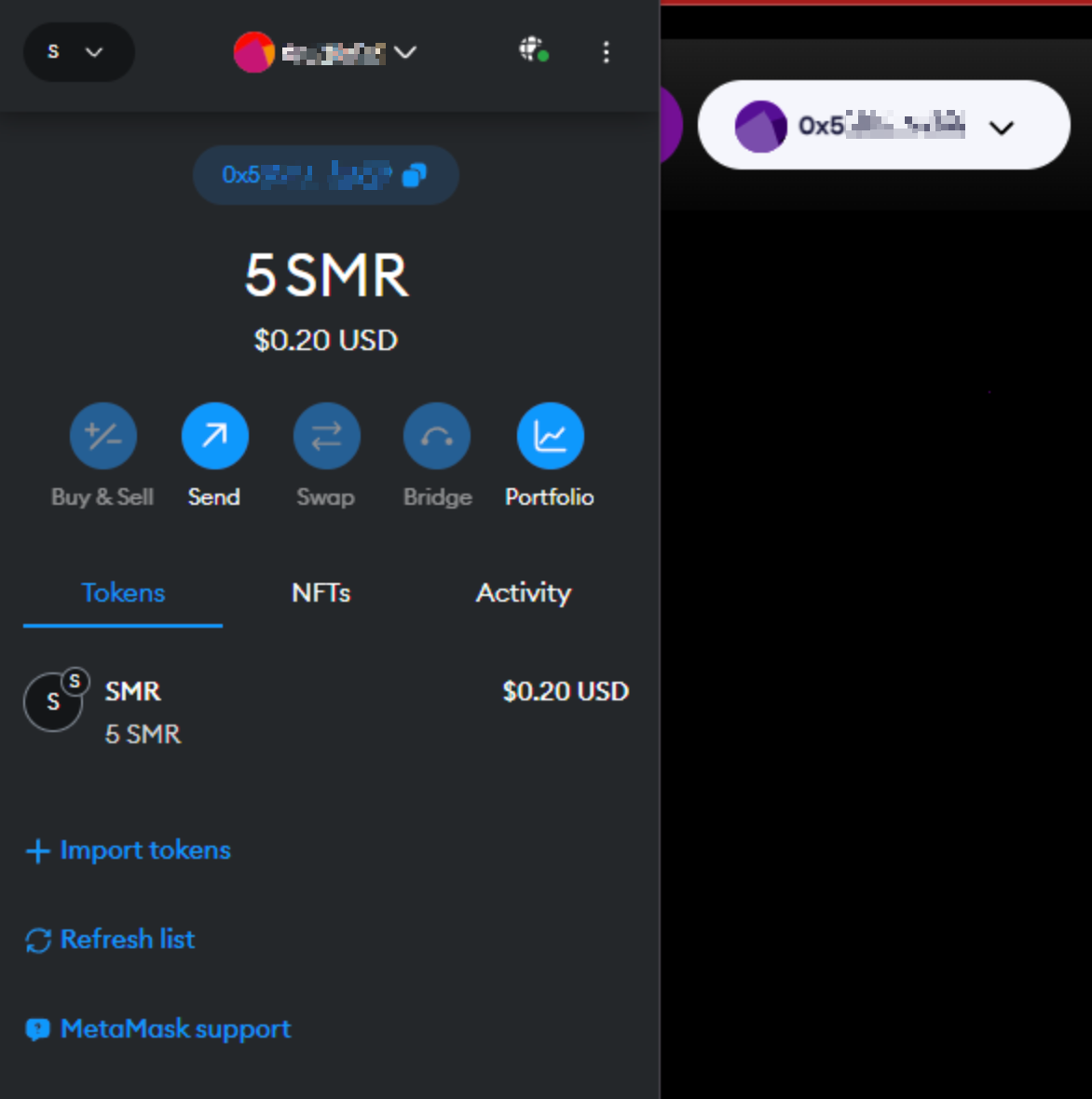

Step 2: Confirm your MetaMask has sufficient $SMR for gas fees

If your MetaMask is missing some $SMR for gas fees, follow the steps below:

- Connect MetaMask to Shimmer and check your $SMR balance.

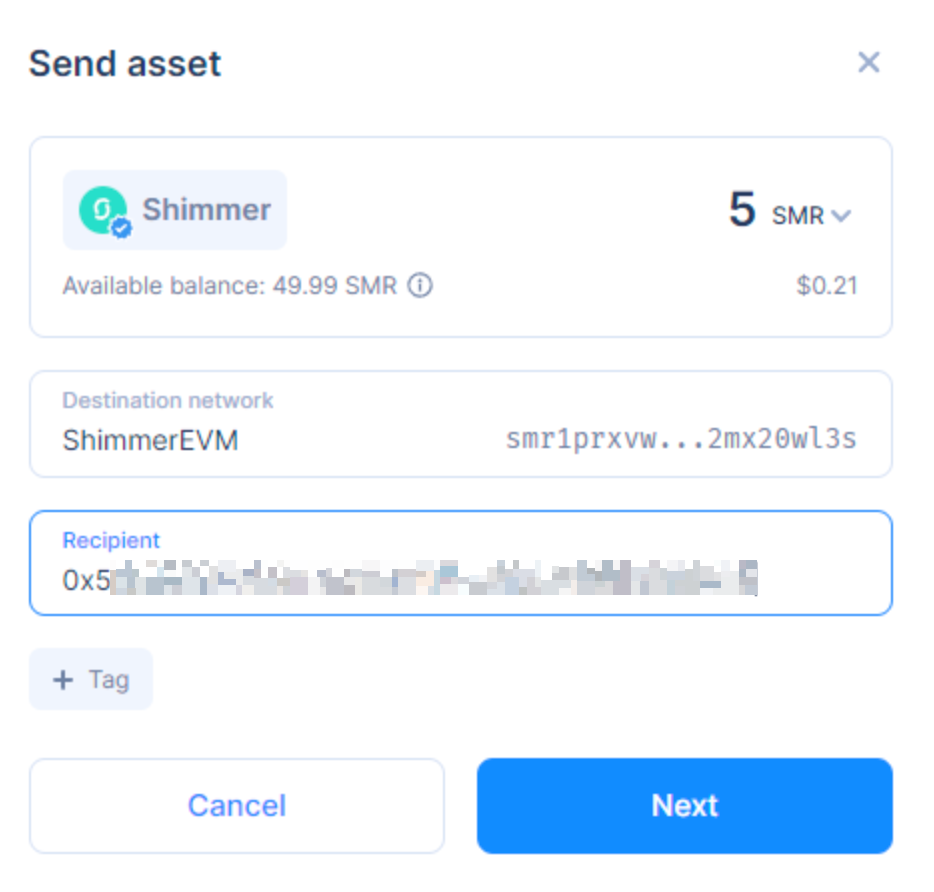

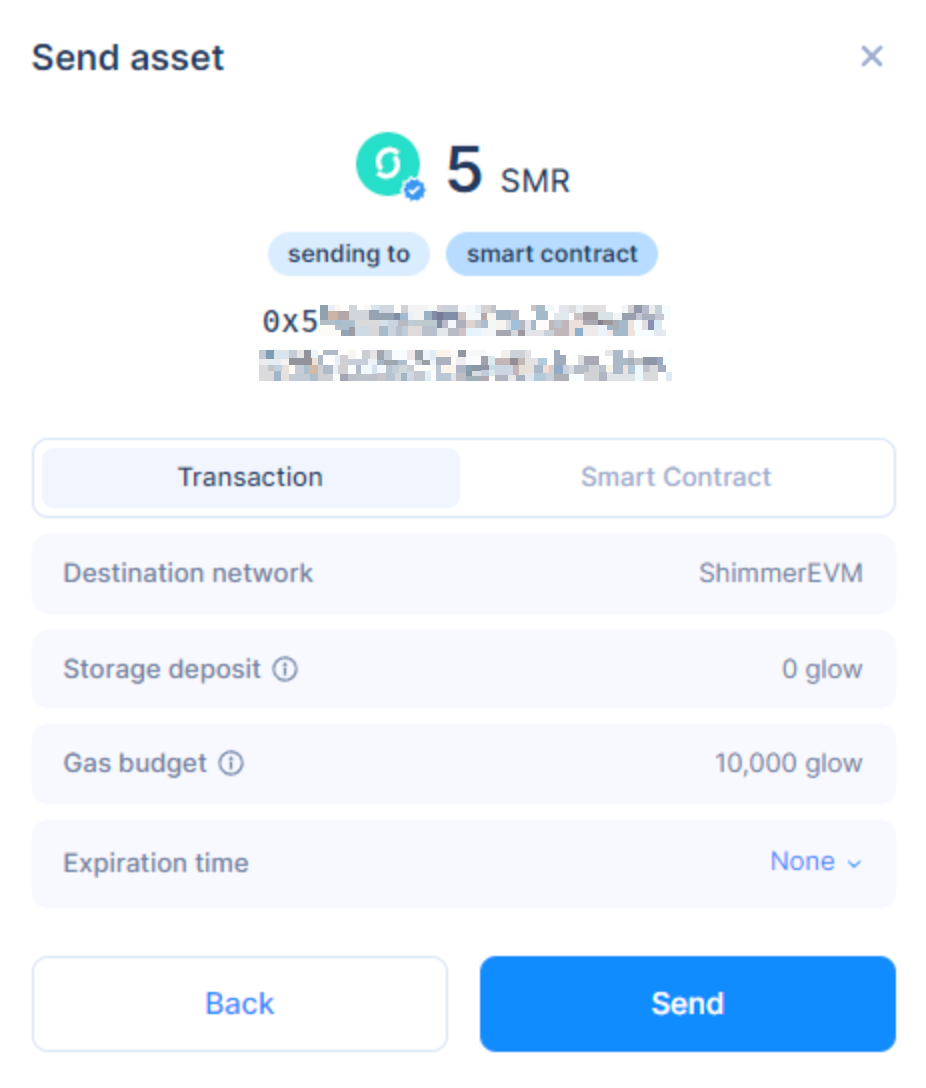

- In Firefly Shimmer Wallet, navigate to the

Send assetsection. Choose the amount of $SMR you wish to transfer, which will be used for future gas fees on the ShimmerEVM. SetShimmerEVMas the Destination network, and enter your MetaMask address as the recipient. Click onNext.

- Confirm the details and

Sendthe $SMR to MetaMask.

- Your $SMR will arrive on your MetaMask wallet within a few seconds.

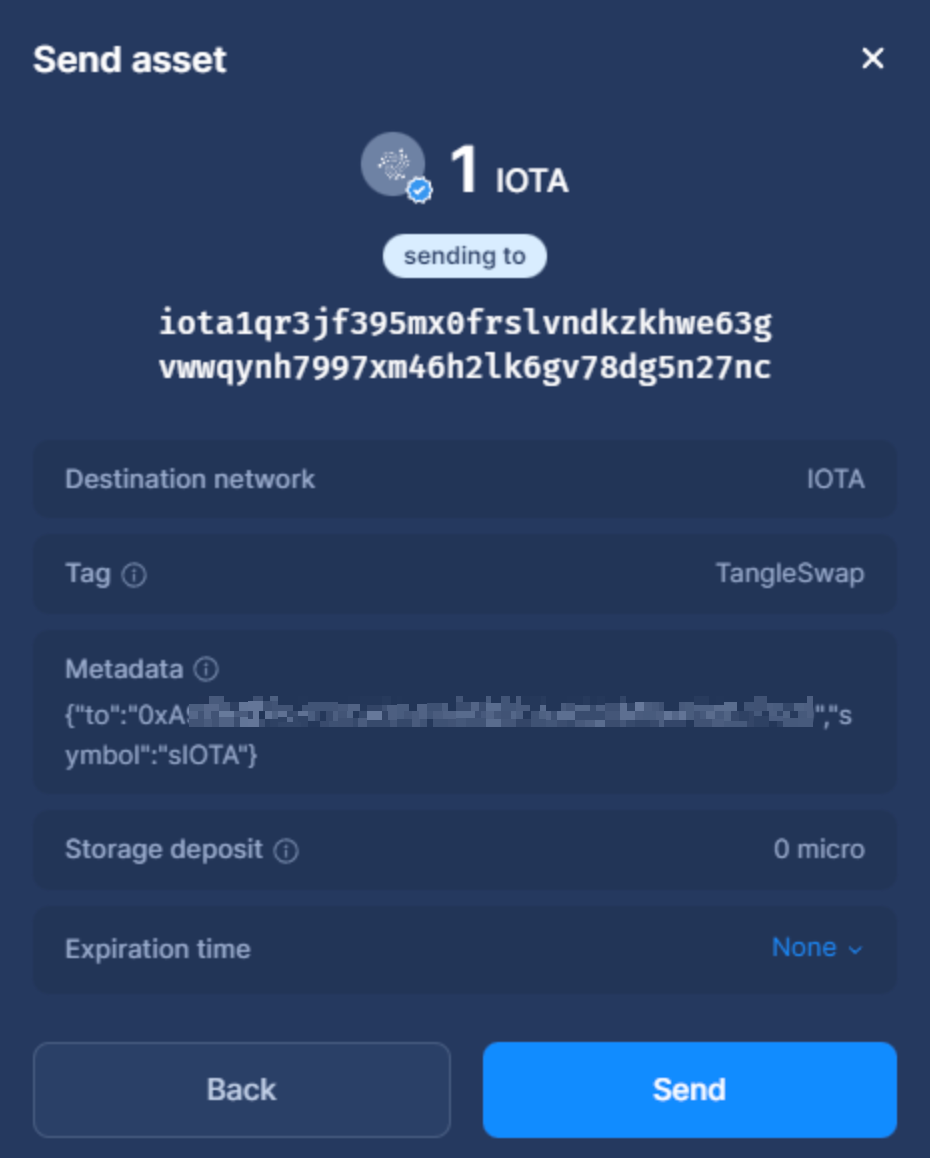

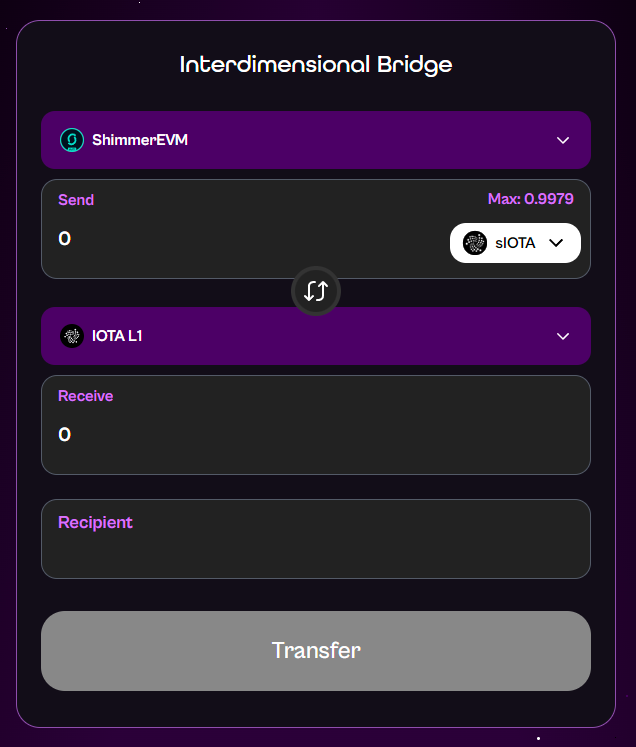

Step 3: Bridging $IOTA to MetaMask

The payment token for participating in the $VOID public token sale on Shimmer is sIOTA, the wrapped version of your native L1 $IOTA that lives in the L2 ShimmerEVM.

Follow these steps to convert your $IOTA in Firefly IOTA, into sIOTA that can be used with MetaMask.

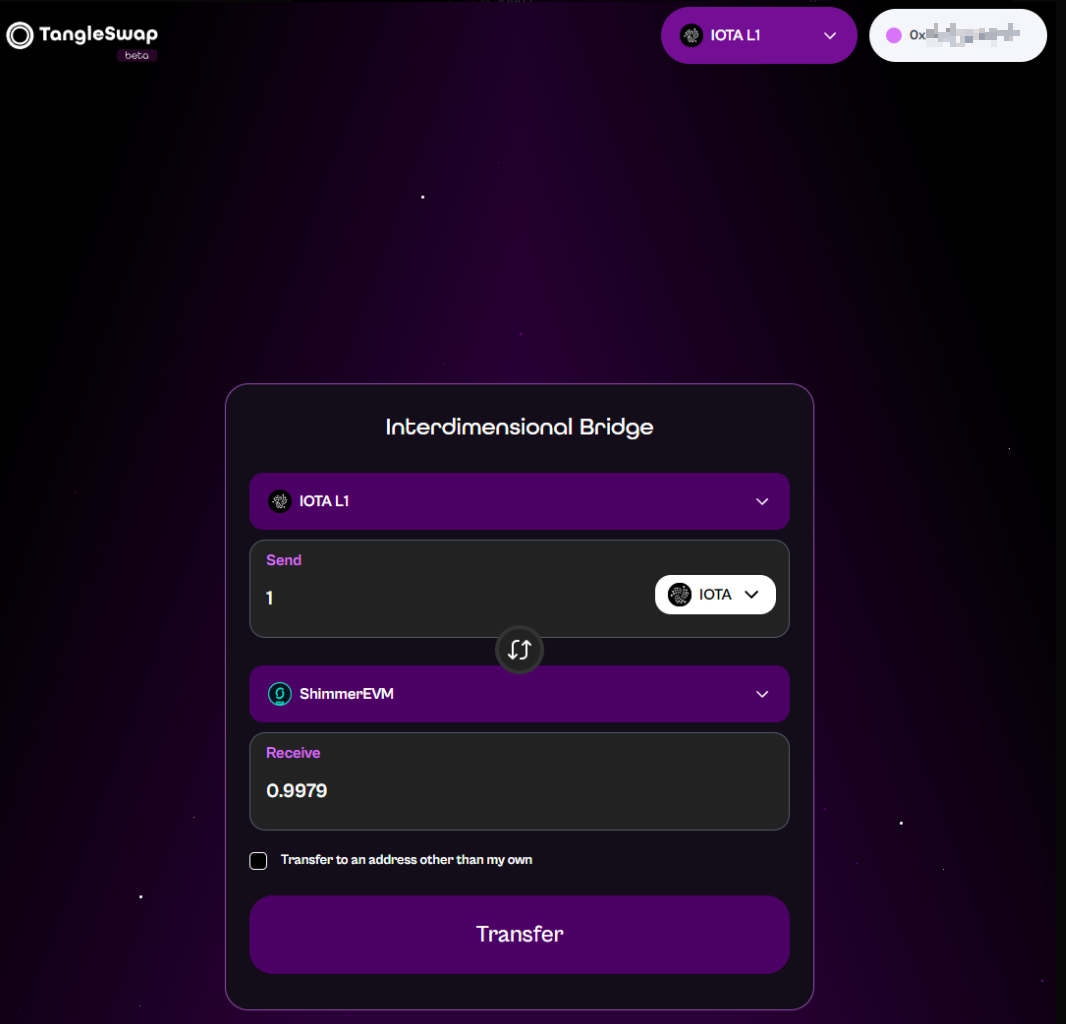

Navigate to the Interdimensional Bridge interface.

Connect your wallet to TangleSwap.

Select IOTA L1 as the

Origin Chain, serving as the starting point for your asset transfer, and ShimmerEVM as theDestination Chainto which your assets will be transferred to. Then, select the amount of $IOTA you want to transfer, and click onTransfer.

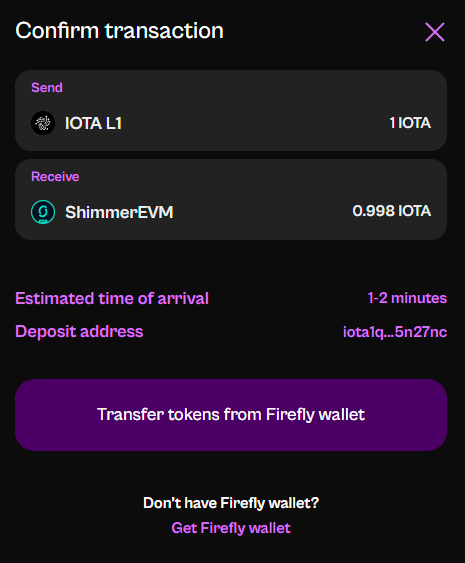

Click on

Transfer tokens from Firefly Wallet.

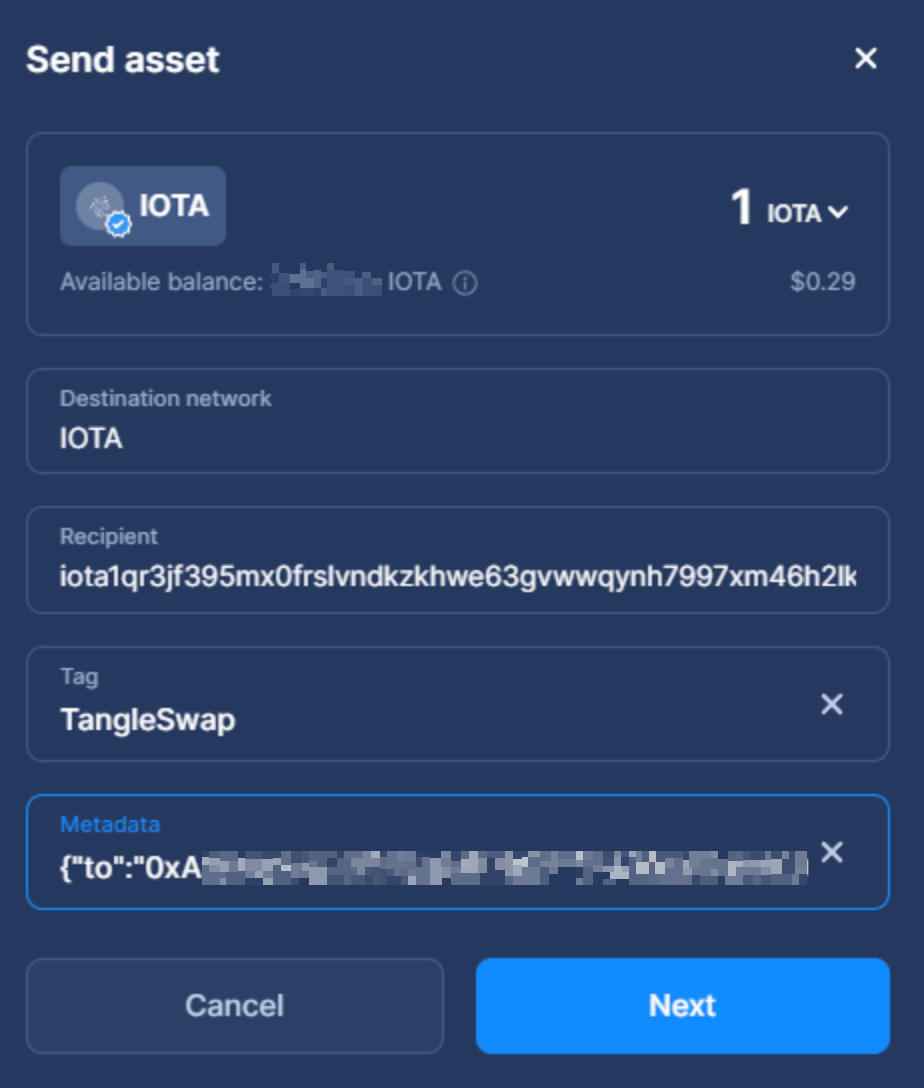

All the information on this screen will be auto-filled for you. Click on

Next.

Click on

Sendand enter your Firefly IOTA password.

A few seconds later your

sIOTAwill arrive into your MetaMask wallet.

And that's it! You're all set to jump into the next phase.

Phase Two — Participate in the Sale

- Sale on Cardano — Eternl/Nami

- Sale on Cardano — MetaMask

- Sale on IOTA — MetaMask

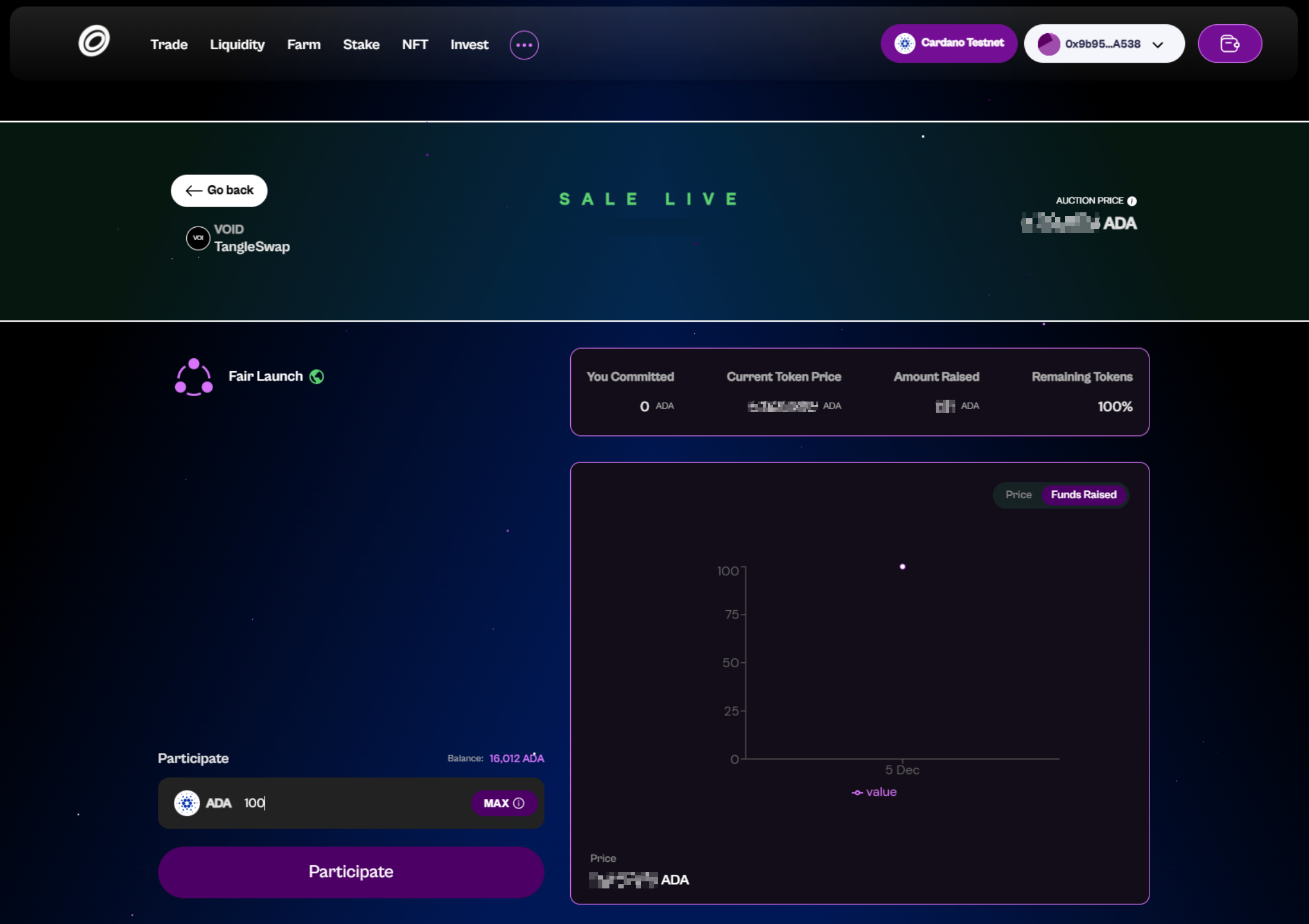

The entire process is securely managed through TangleSwap’s self-custodial and fully permissionless Launchpad, known as the Investment Hub. This platform ensures that the sale process is decentralized and governed by Smart Contracts, with the distribution of funds occurring only after the sale is concluded. For those eager to learn more about it, we’ve compiled an array of resources to guide you:

- Overview & Features of the Investment Hub

- Audit Report, by Zokyo (prev. audits include LayerZero, Aurora, and more)

Follow these steps to participate in the $VOID sale on Cardano with your Eternl/Nami browser extension:

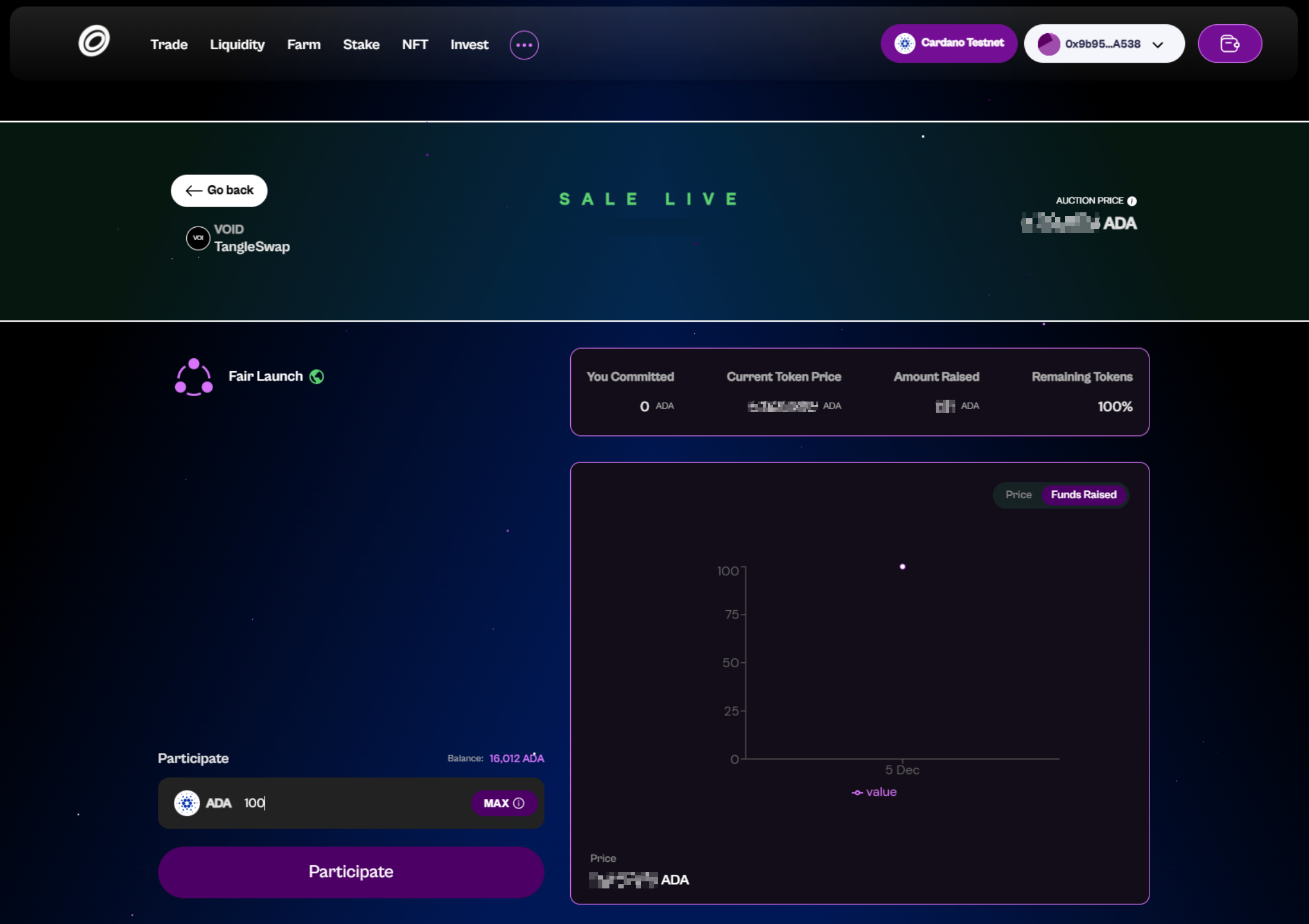

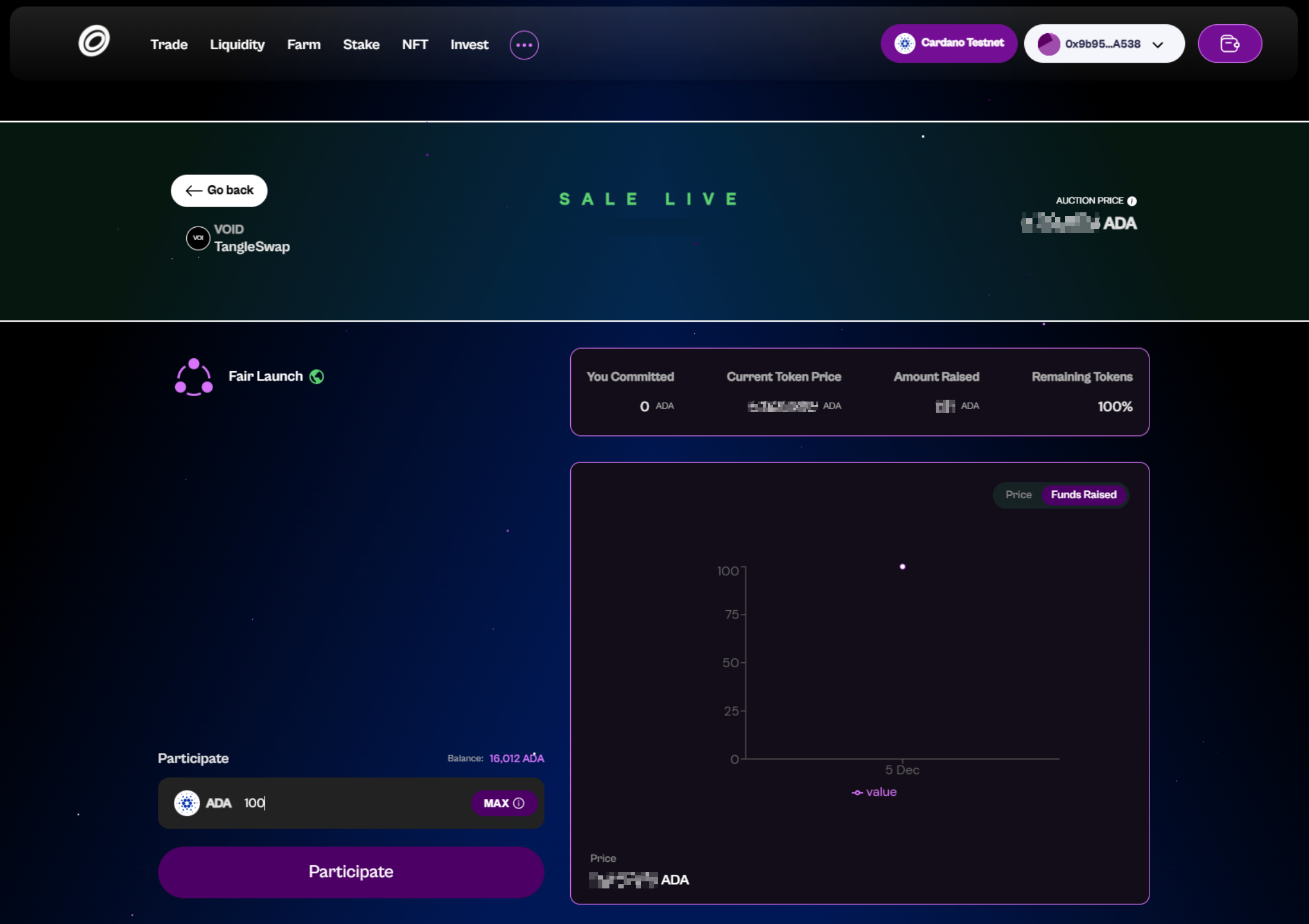

Step 1: Navigate to the Investment Hub interface.

Step 2: Connect your wallet to TangleSwap. Select

Cardano.

Step 3: Select the

$VOID - Fair Launchauction.

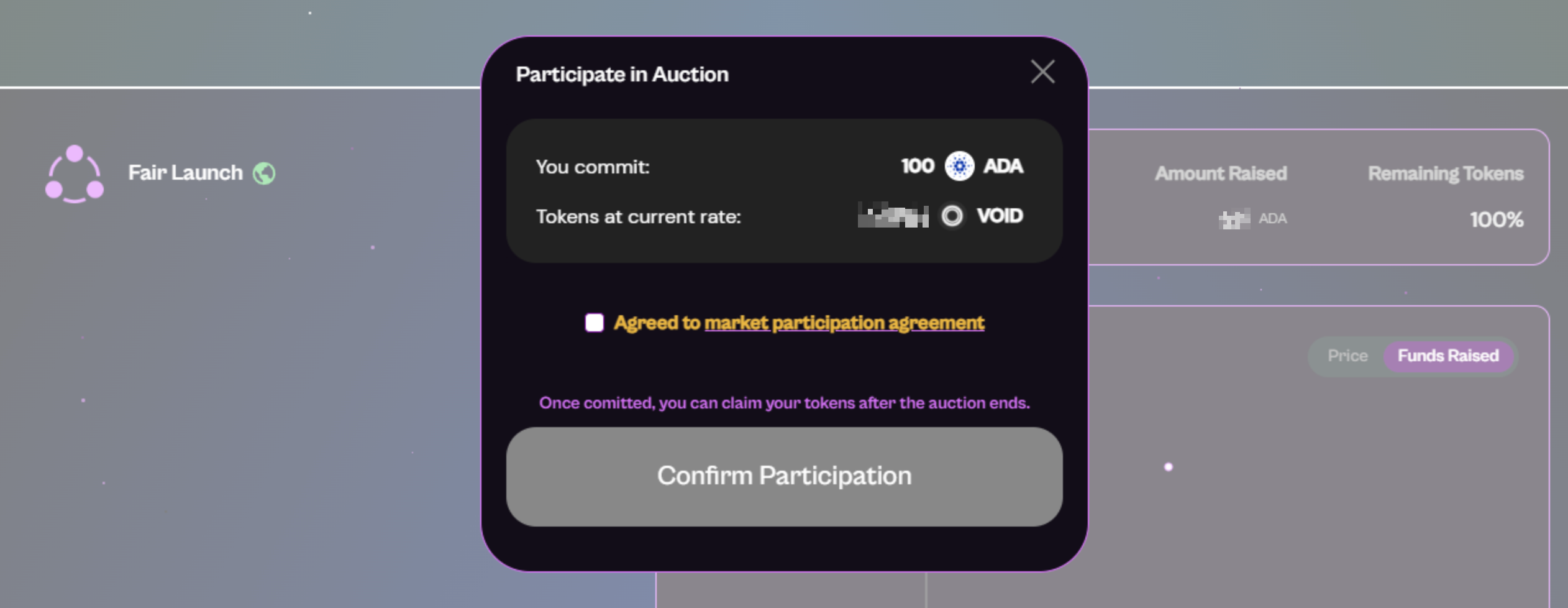

Step 4: Enter the amount of $ADA you wish to invest for acquiring $VOID, then click on

Participate.

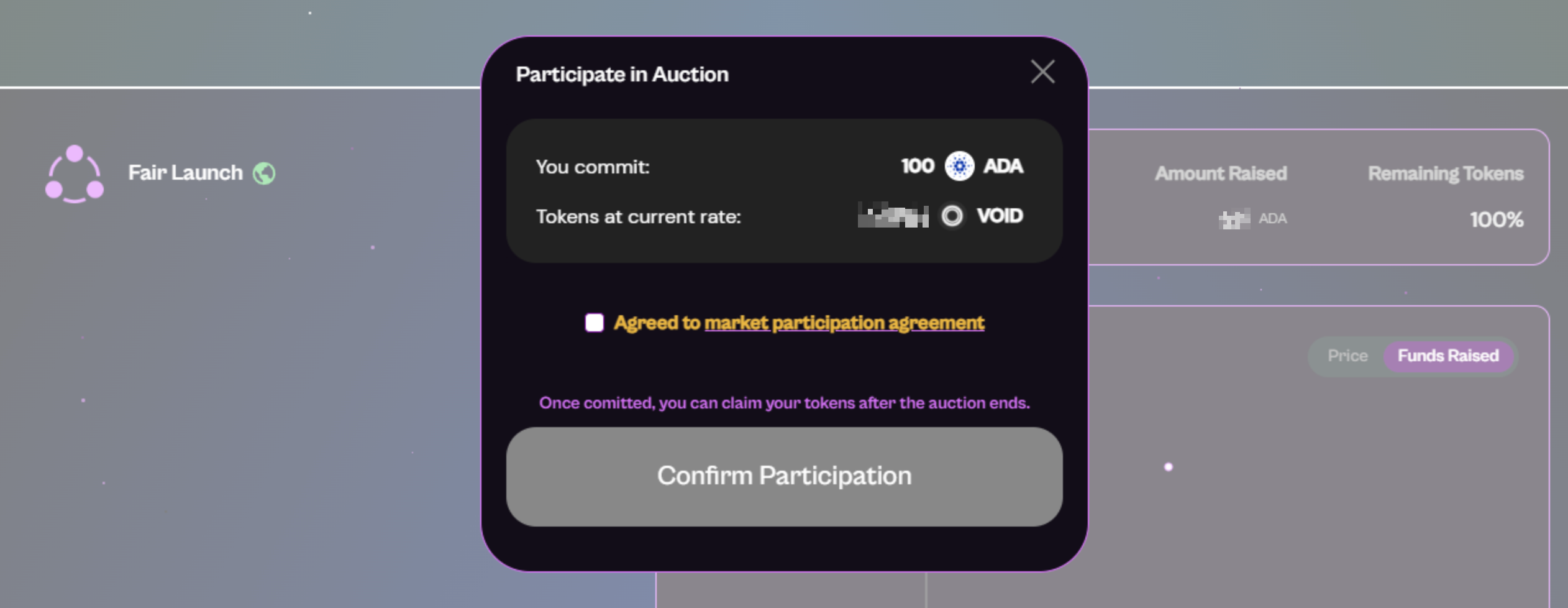

Step 5:

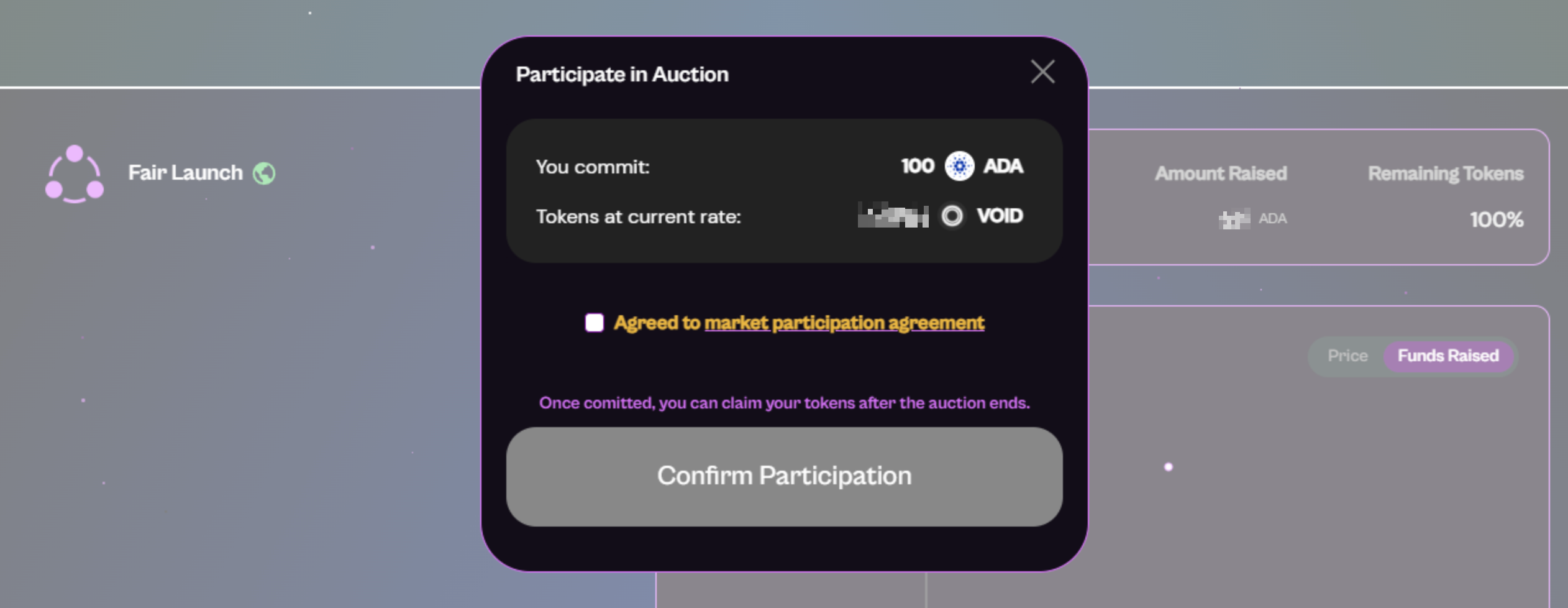

Agreeto the market participation agreement, andConfirm Participation.

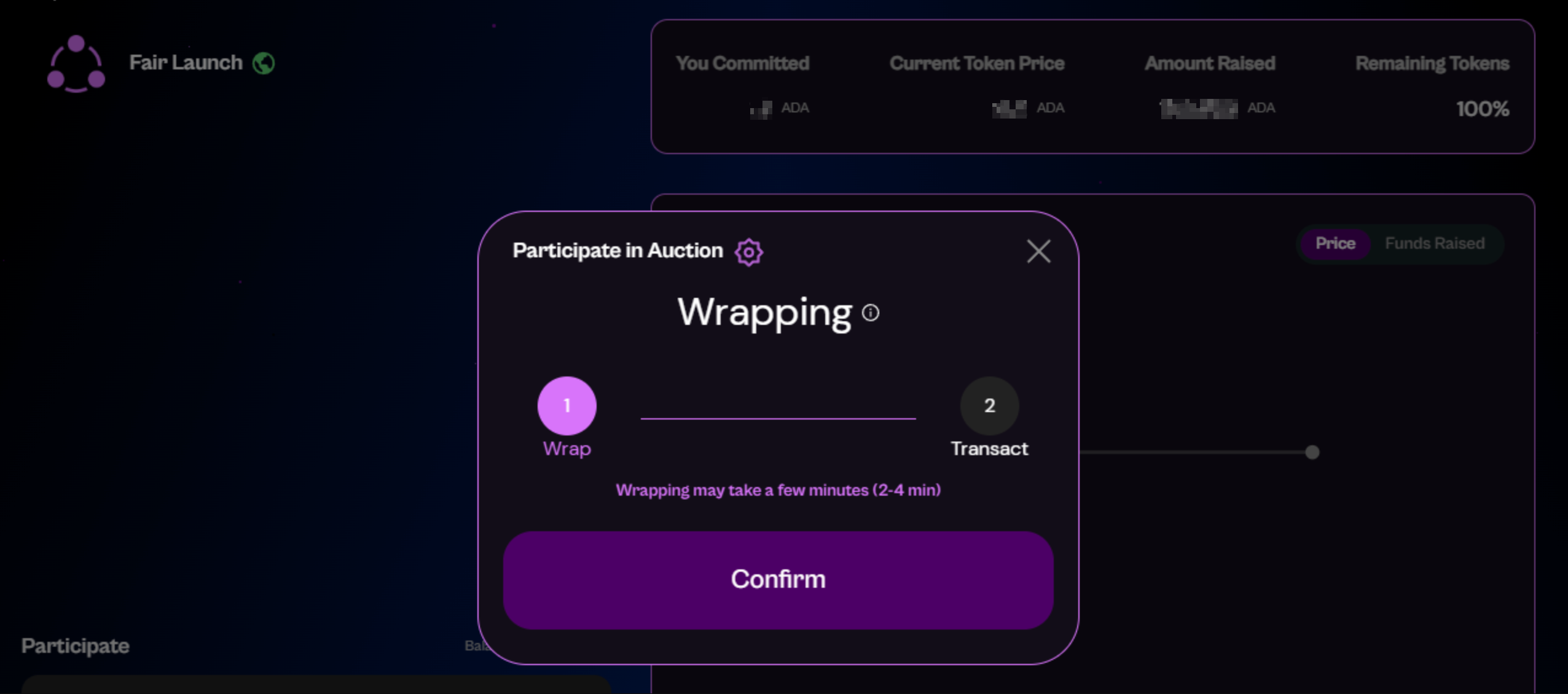

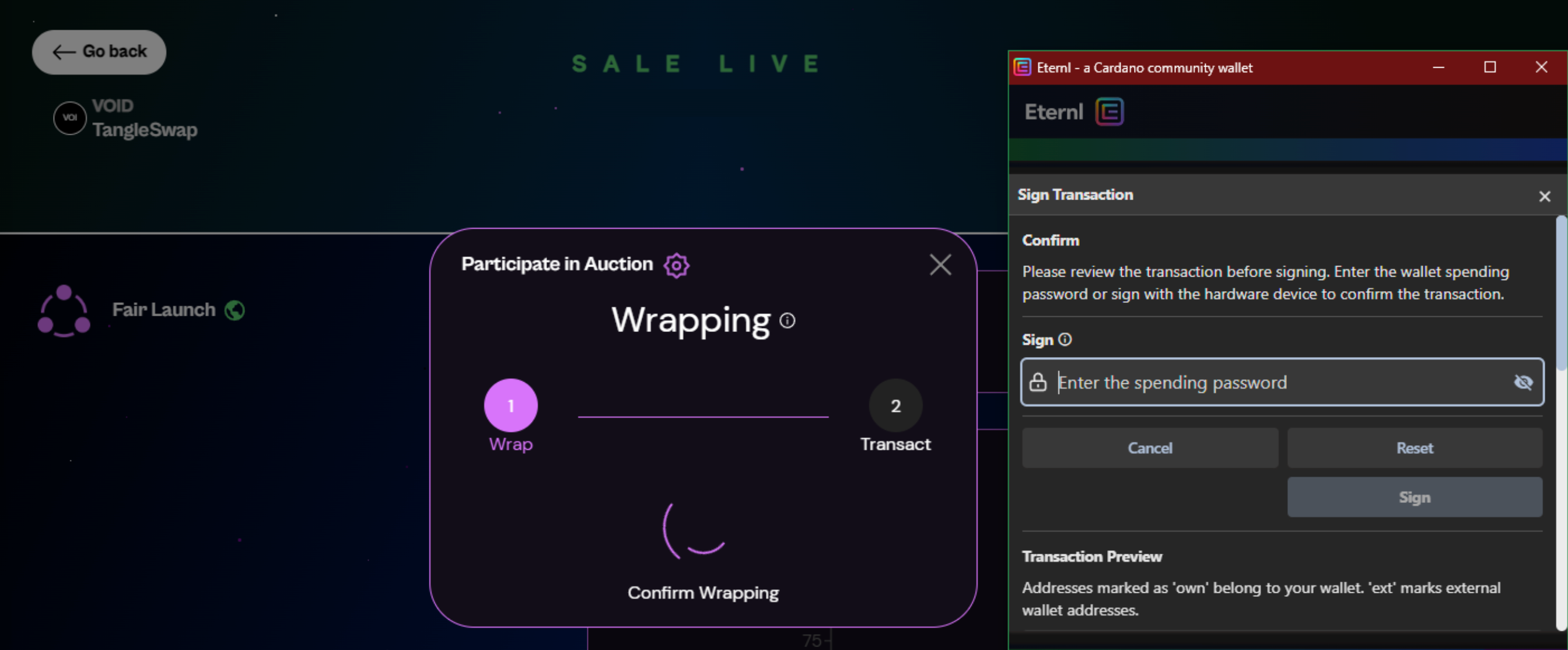

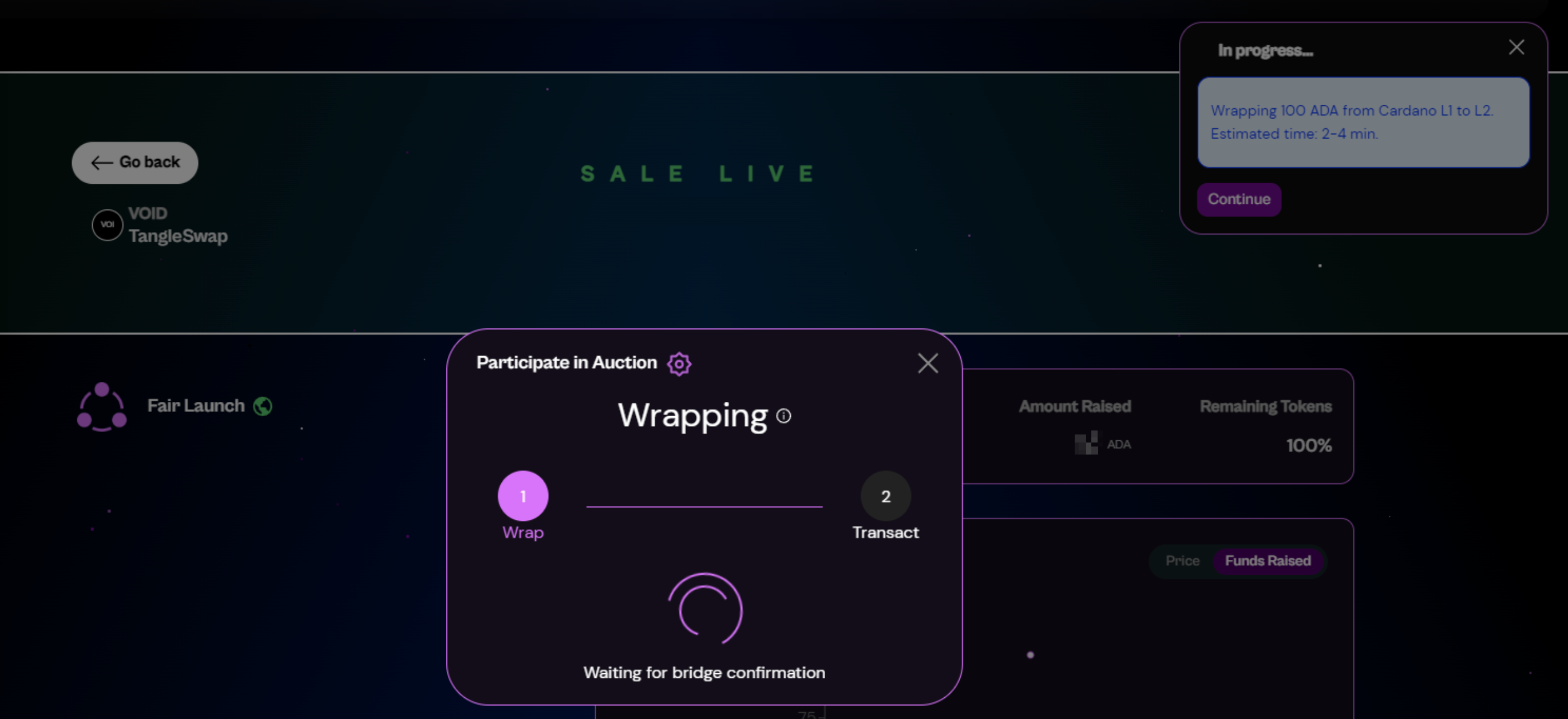

Step 6: Click on

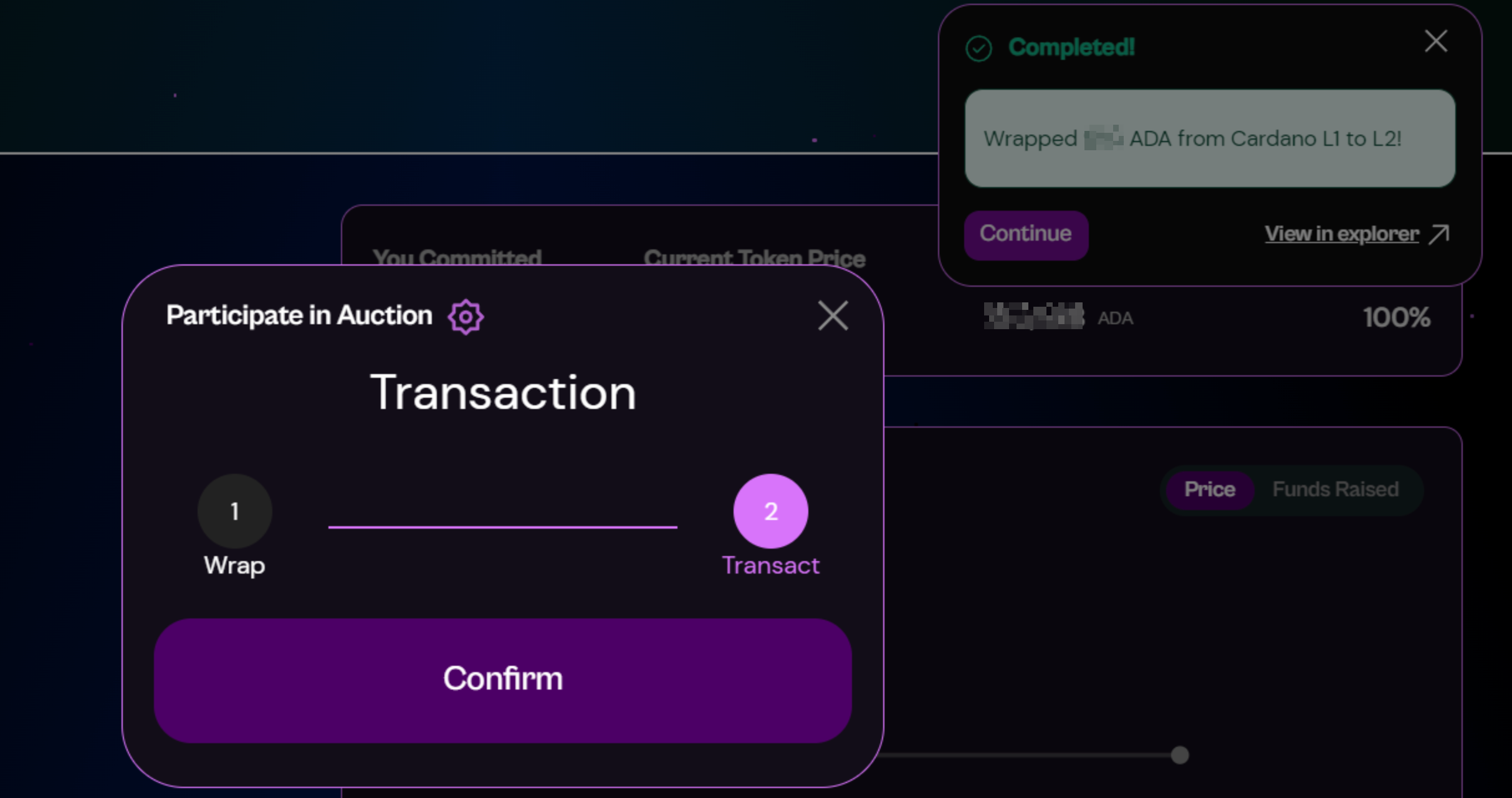

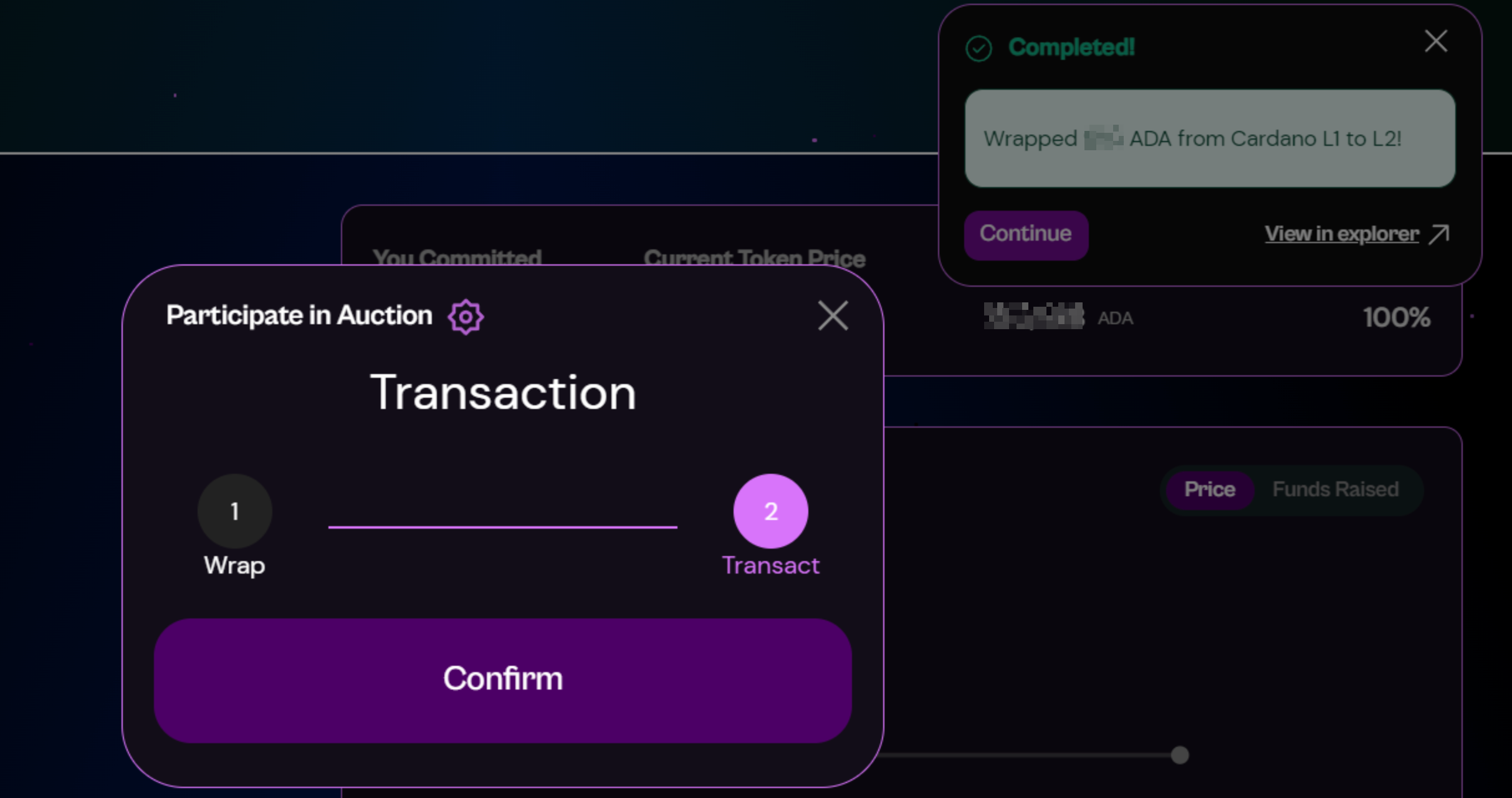

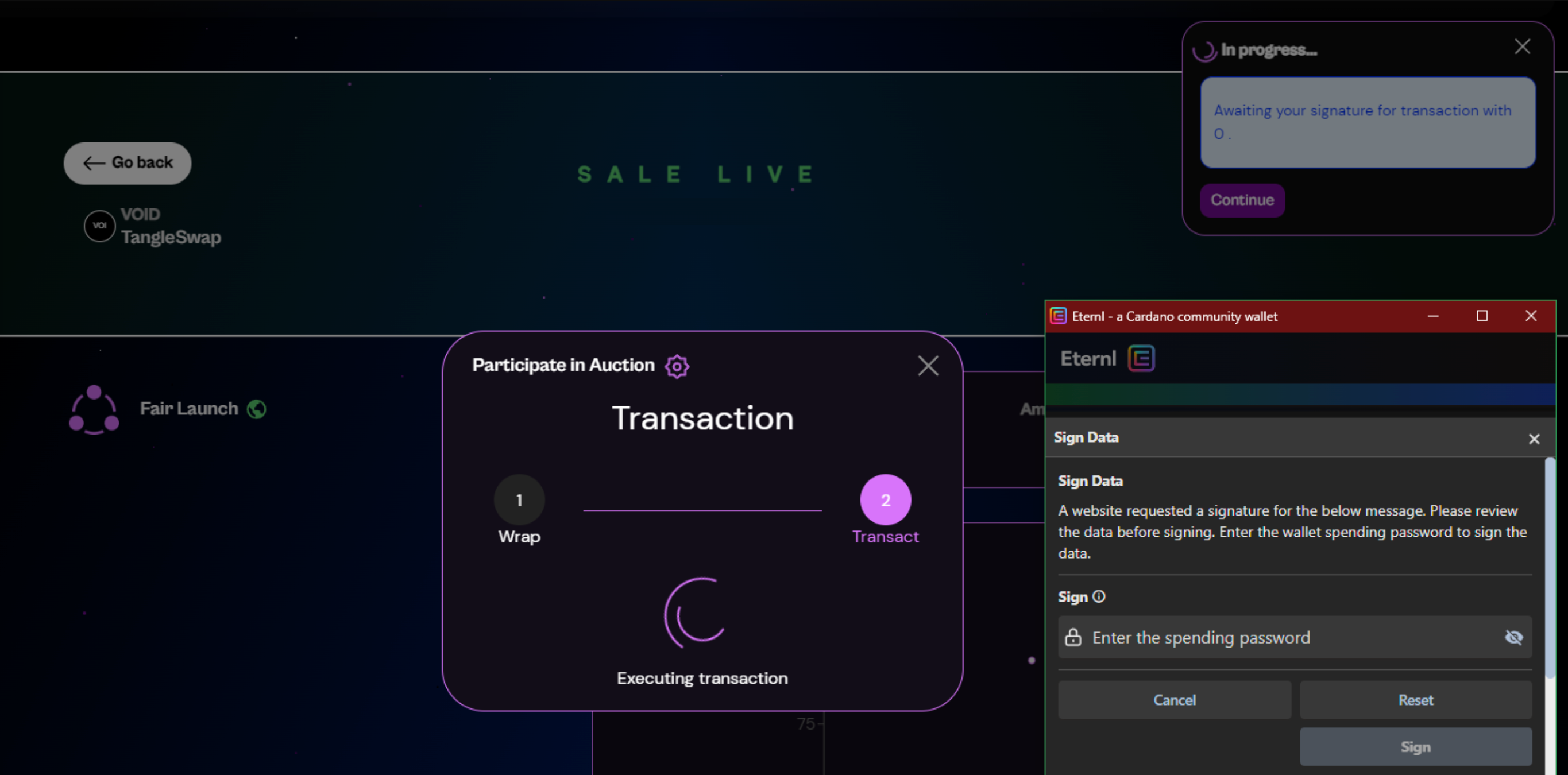

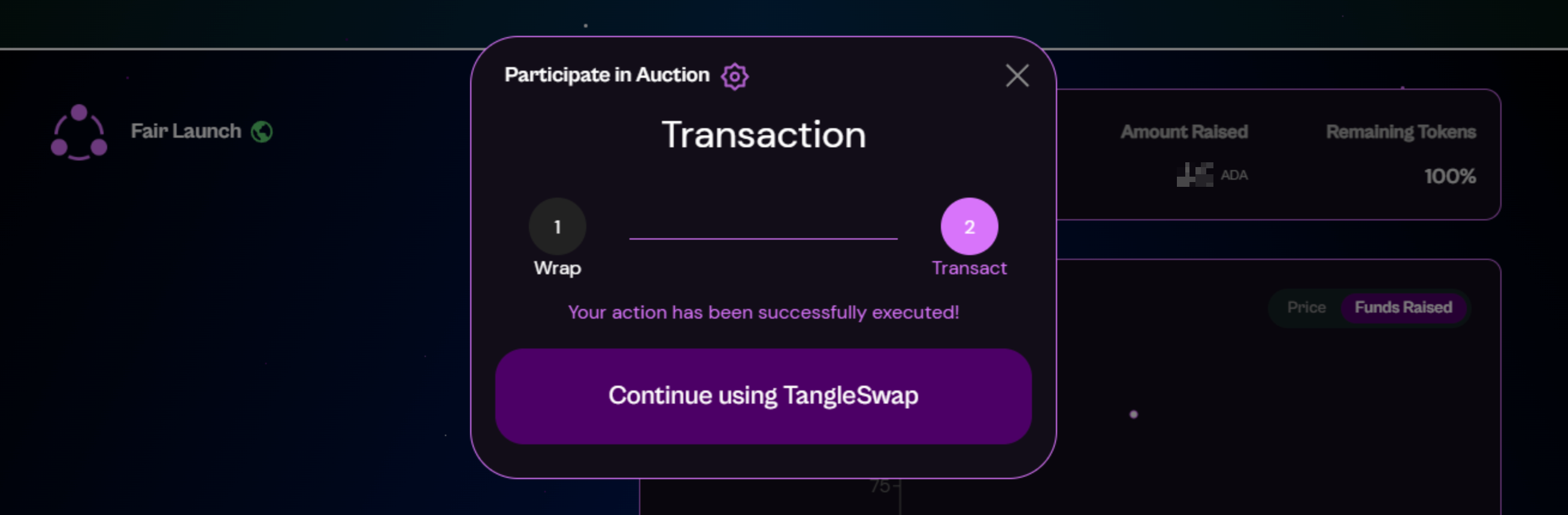

Confirm, andSignthe Wrap transaction in your wallet. Estimated time: 2-4 minutes.

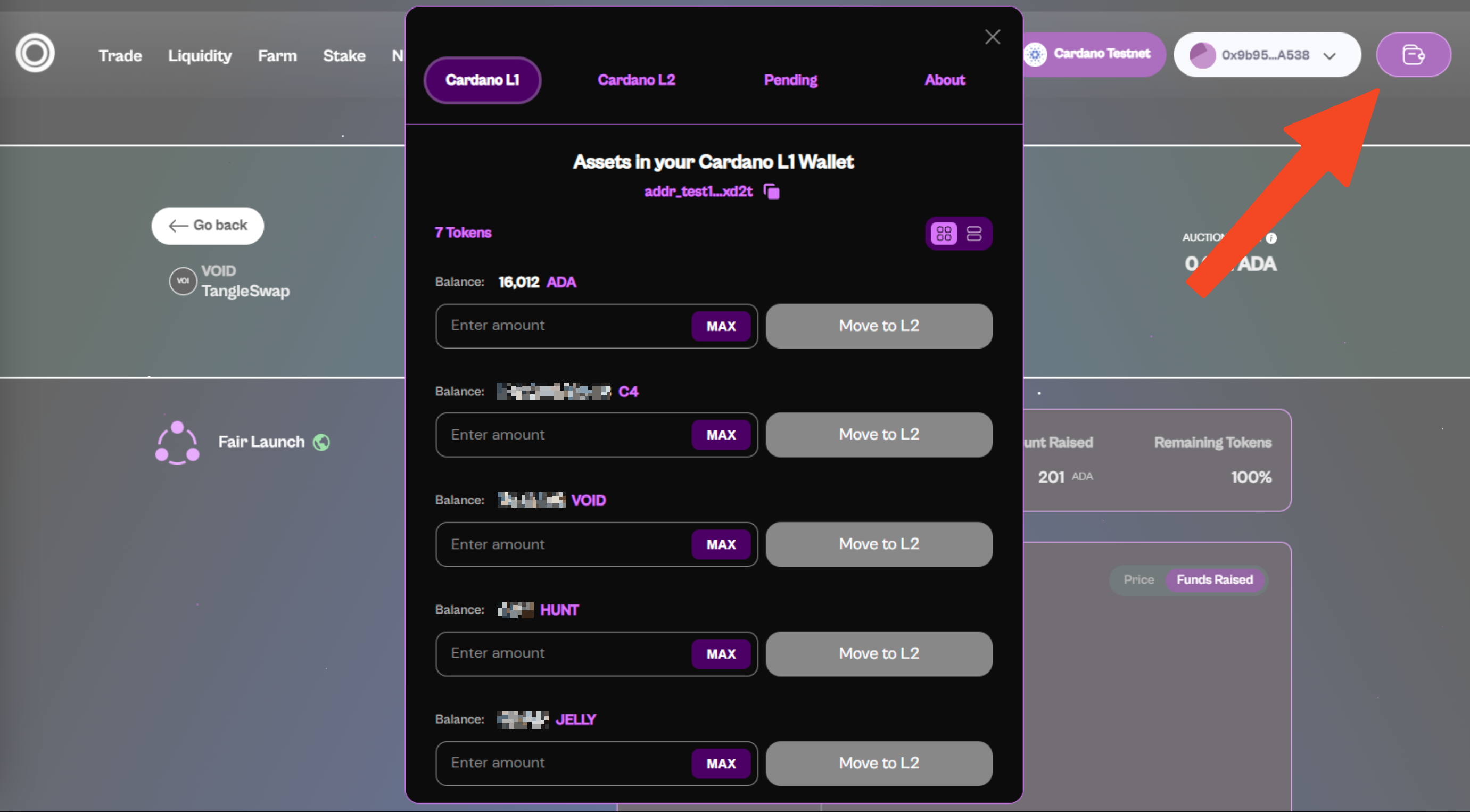

Wrapped Smart Contracts (WSCs) serve as a key infrastructure component for both TangleSwap and Cardano, enabling a native user experience with seamless, interoperable interactions. TangleSwap handles the process automatically for you, but if you'd like to perform any manual operations, the Wallet Widget feature — illustrated below — enables you to seamlessly transfer tokens between Cardano L1 and L2. Click on the About section to learn more about WSCs.

Step 7: Once the Wrap is completed, click on

ConfirmandSignyour Transact operation in your wallet. Estimated time: a few seconds.

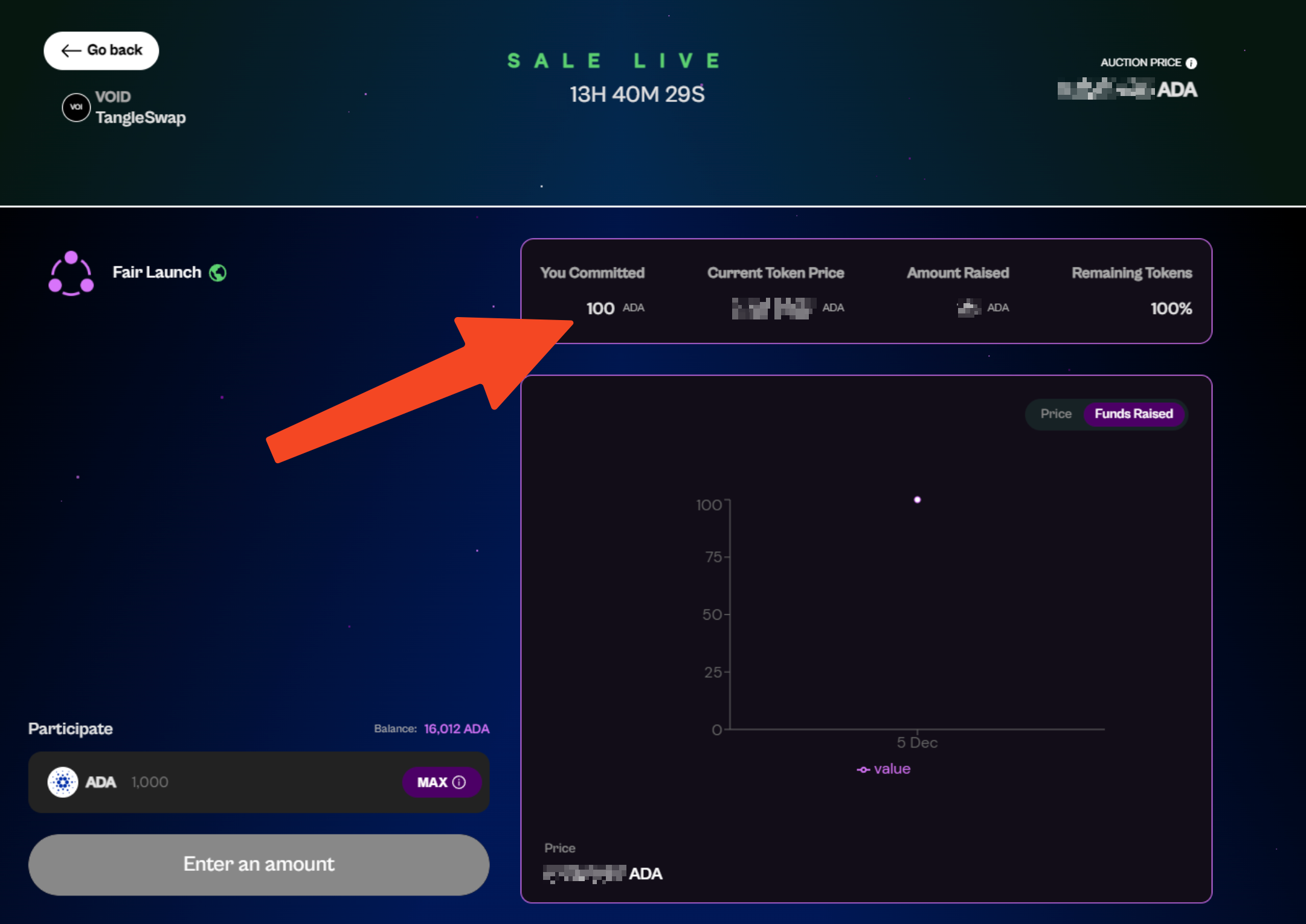

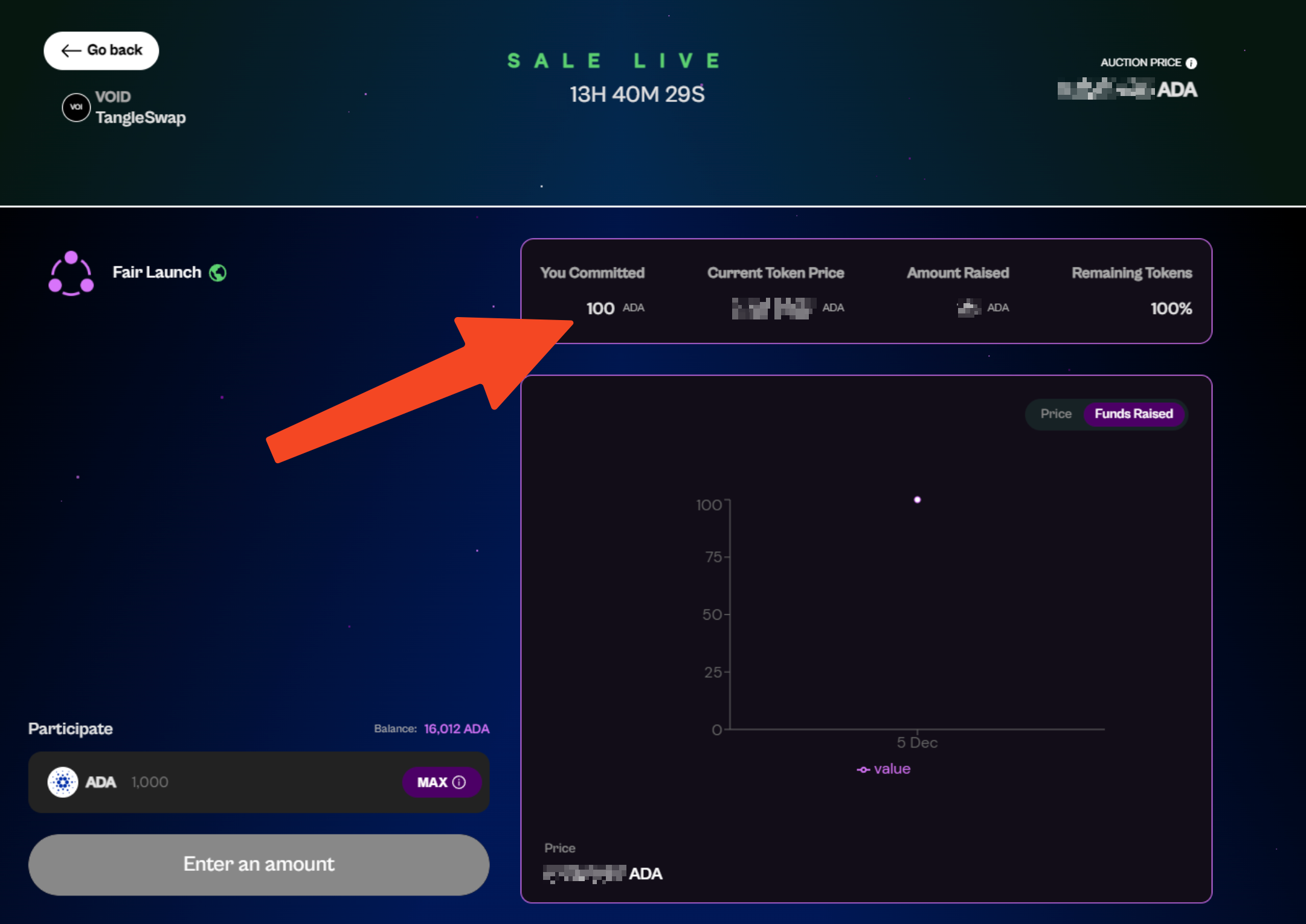

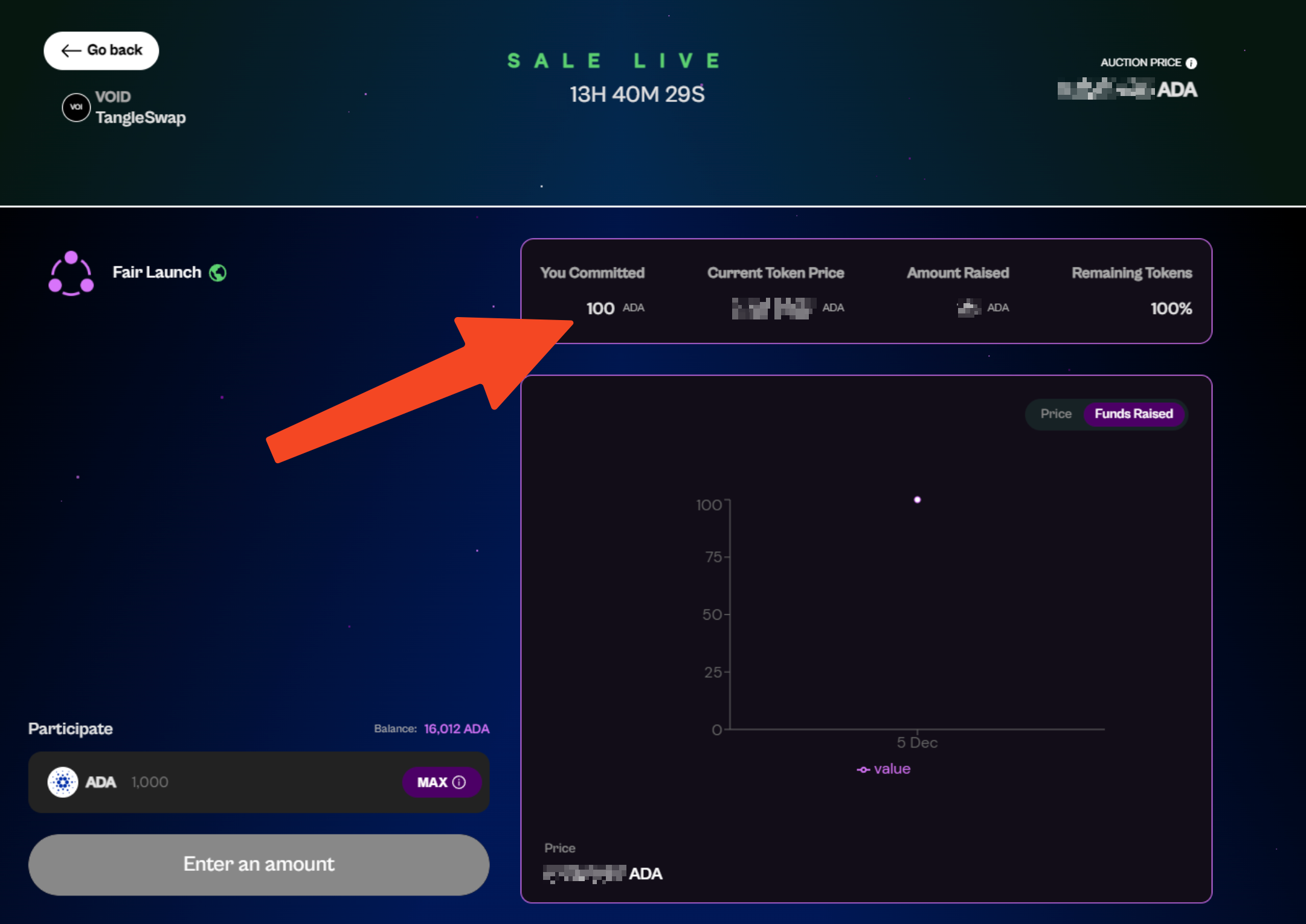

Step 8: Congratulations! You've successfully secured your stake in the TangleSwap $VOID token sale.

Please note that you can increase your stake at any time before the auction finalizes by repeating steps 4-7 above. TangleSwap will automatically skip step 6 (Wrap) if you already have sufficient $ADA in your L2 wallet.

Once you're happy with your current stake in the auction, simply wait until the sale concludes to claim your tokens. We appreciate your participation in building the future of Decentralized Finance, Explorer. 🛸

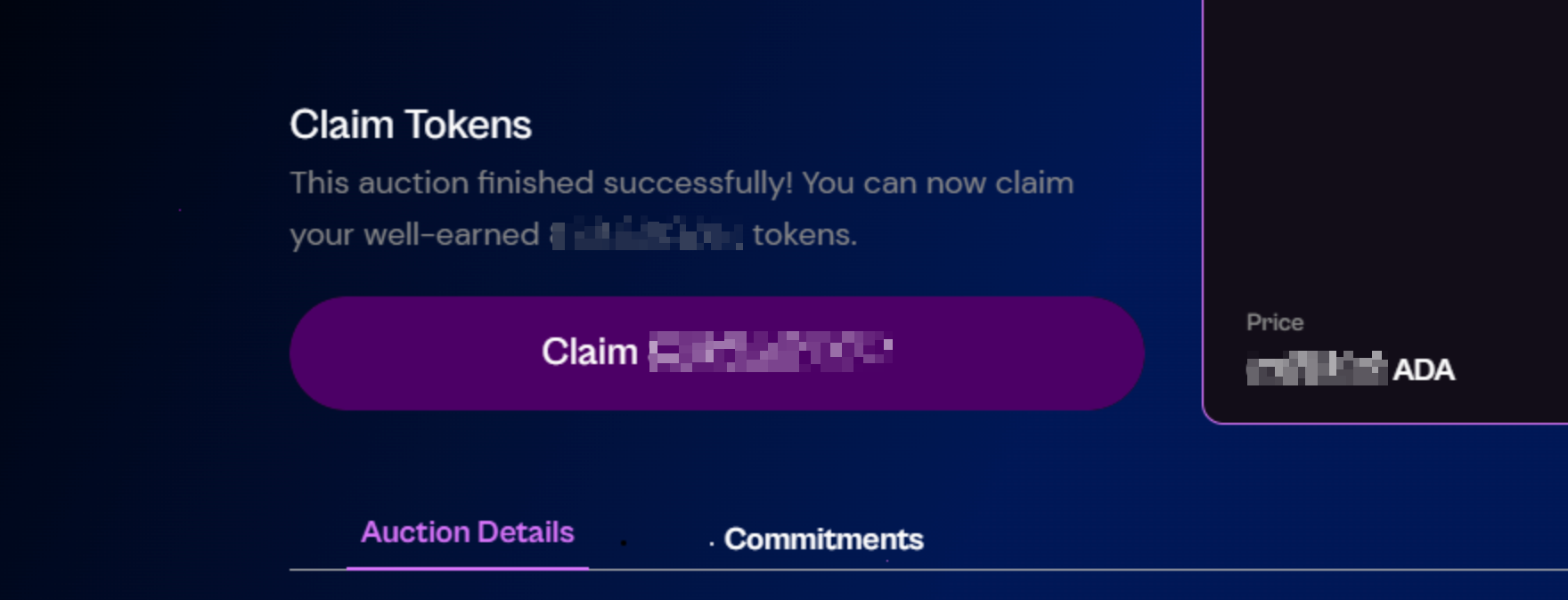

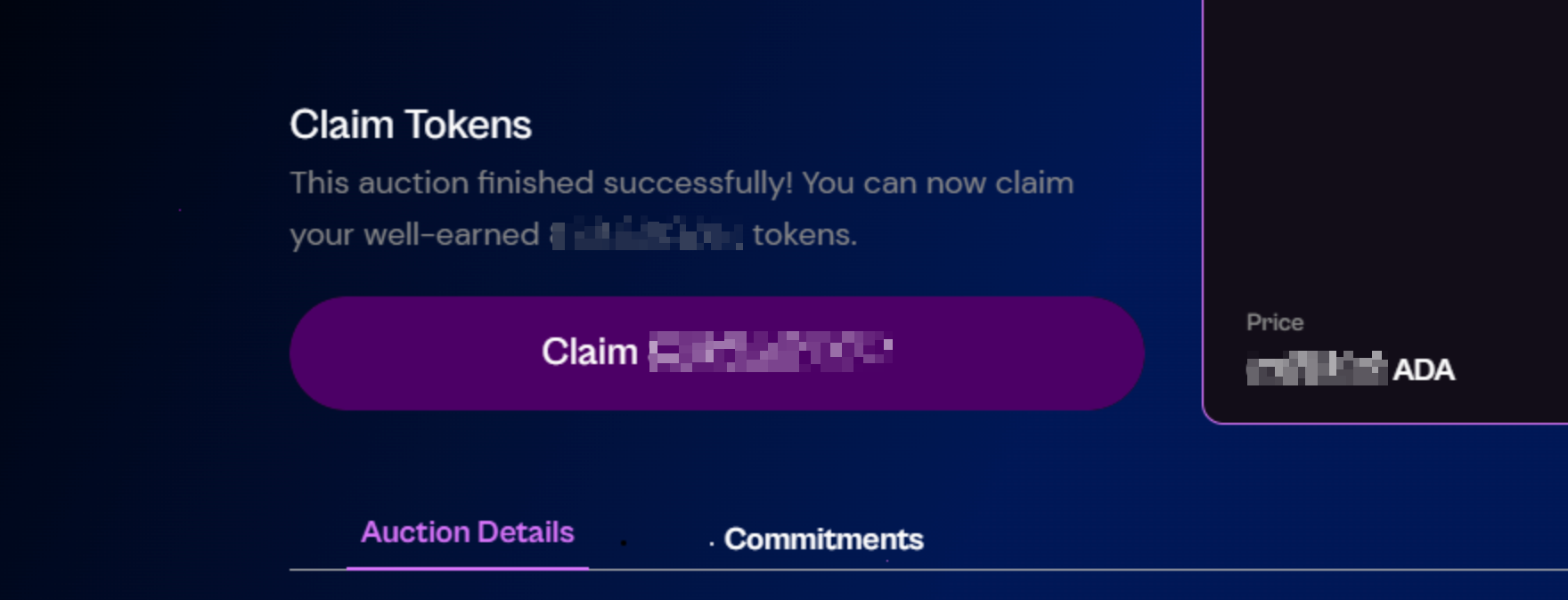

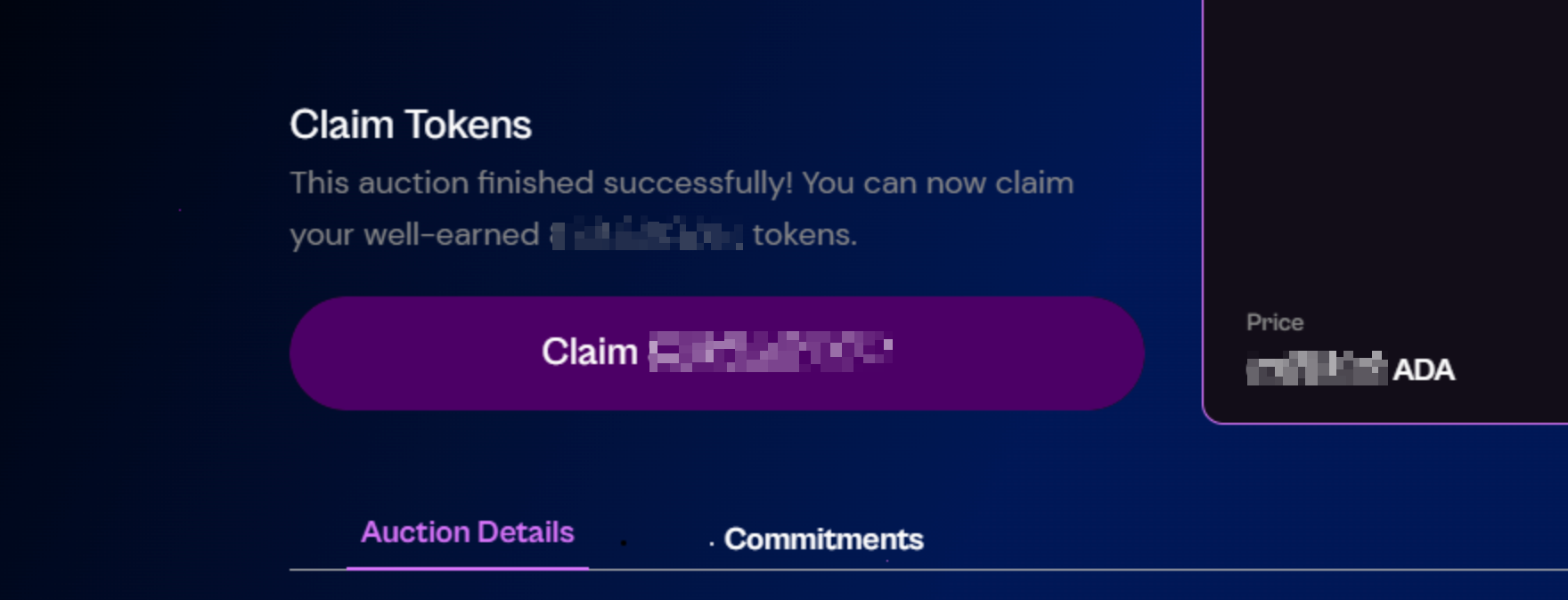

Step 9: After the successful completion of the auction, you're all set to

Claimyour well-earned $VOID tokens.Note: In the event of an auction not reaching the minimum set goal, TangleSwap's Investment Hub would offer users to reclaim their original $ADA by following the same claiming process outlined below.

The entire process is securely managed through TangleSwap’s self-custodial and fully permissionless Launchpad, known as the Investment Hub. This platform ensures that the sale process is decentralized and governed by Smart Contracts, with the distribution of funds occurring only after the sale is concluded. For those eager to learn more about it, we’ve compiled an array of resources to guide you:

- Overview & Features of the Investment Hub

- Audit Report, by Zokyo (prev. audits include LayerZero, Aurora, and more)

Participating in the Cardano sale with MetaMask aligns closely with the Eternl/Nami experience, with two key distinctions:

- Before the sale starts, you'll need your Nami wallet to wrap your $ADA from Cardano L1 to L2 in MetaMask, as outlined in Phase One.

- While the sale is active, you do not need to Wrap or Unwrap your $ADA, since it's already on the L2. The only step required is

Transact, which is almost instant.

To illustrate the simplicity of the whole process, below is a 50-seconds video illustrating how to participate in the VOID token sale on Cardano, using MetaMask:

Step 1: Navigate to the Investment Hub interface.

Step 2: Connect your wallet to TangleSwap. Select

Cardano.

Step 3: Select the

$VOID - Fair Launchauction.

Step 4: Enter the amount of $ADA you wish to invest for acquiring $VOID, then click on

Participate.

Step 5:

Agreeto the market participation agreement andConfirm Participation.

Step 6: Click on

Confirmto sign the transaction in your wallet, and wait for the confirmation. Estimated time: a few seconds.

Step 7: Congratulations! You've successfully secured your stake in the TangleSwap $VOID token sale.

Please note: you can increase your stake at any time before the auction ends by repeating steps 4-6 above.

Once you're happy with your current stake in the auction, simply wait until the sale concludes to claim your tokens. We appreciate your participation in building the future of Decentralized Finance, Explorer. 🛸

Step 8: After the successful completion of the auction, you're all set to

Claimyour well-earned $VOID tokens.Note: In the event of an auction not reaching the minimum set goal, TangleSwap's Investment Hub would offer users to reclaim their original $ADA by following the same claiming process outlined below.

The entire process is securely managed through TangleSwap’s self-custodial and fully permissionless Launchpad, known as the Investment Hub. This platform ensures that the sale process is decentralized and governed by Smart Contracts, with the distribution of funds occurring only after the sale is concluded. For those eager to learn more about it, we’ve compiled an array of resources to guide you:

- Overview & Features of the Investment Hub

- Audit Report, by Zokyo (prev. audits include LayerZero, Aurora, and more)

To illustrate the simplicity of the whole process, below is a 50-seconds video illustrating how to participate in the VOID token sale using MetaMask:

Please note, while the video and screenshots below use the Cardano Testnet for demonstration, the steps are identical for IOTA/Shimmer except for the network (ShimmerEVM Mainnet) and payment token (sIOTA).

Step 1: Navigate to the Investment Hub interface.

Step 2: Connect your wallet to TangleSwap. Select

ShimmerEVM.

Step 3: Select the

$VOID - Fair Launchauction.

Step 4: Enter the amount of

sIOTAyou wish to invest for acquiring $VOID, then click onParticipate.

Step 5:

Agreeto the market participation agreement andConfirm Participation.

Step 6: Click on

Confirmto sign the transaction in your wallet, and wait for the confirmation. Estimated time: a few seconds.

Step 7: Congratulations! You've successfully secured your stake in the TangleSwap $VOID token sale.

Please note: you can increase your stake at any time before the auction ends by repeating steps 4-6 above.

Once you're happy with your current stake in the auction, simply wait until the sale concludes to claim your tokens. We appreciate your participation in building the future of Decentralized Finance, Explorer. 🛸

Step 8: After the successful completion of the auction, you're all set to

Claimyour well-earned $VOID tokens.Note: In the event of an auction not reaching the minimum set goal, TangleSwap's Investment Hub would offer users to reclaim their original

sIOTAby following the same claiming process outlined below.

And that's all! Once you have claimed your VOID tokens, these will be available both on Cardano (Layer 1 and Layer 2) and the ShimmerEVM (as well as the IotaEVM once it launches in Q1 2024). The TangleSwap crew has a special announcement prepared in terms of the omnichain interoperability of VOID, so stay tuned for that over the coming weeks...

Next step: put your VOID to work in the TangleSwap ecosystem!